How a Fake Delivery led Outstandly to Build a Creative Studio That Crosses Borders

When Oksana Danyliuk and Serhii Kashevko left Ukraine in early 2022, they thought they were going on a short holiday to a remote island. Then the war...

Tye Bate’s journey into video production wasn’t a traditional one. Born and raised in Australia, he never imagined he’d one day specialise in creating videos for the dental industry - especially since he used to hate going to the dentist. But his passion for storytelling led him down an unexpected path.

Tye taught himself filmmaking from scratch - learning through trial and error, watching online tutorials, and taking on projects wherever he could. “I went to Sydney Film school but felt I learned more through doing and teaching myself. Film school was great for connections though.”

Over time, Tye refined his skills and developed a deep passion for visual storytelling. While he started by creating videos for a range of industries, from hospitality to corporate, he eventually landed a client in the dental field. Tye explains that while many of his friends consider this niche pretty boring, he finds it quite the opposite. He now shoots promotional videos for dentists from short to longer cuts and anything in between.

A lot of patients go through emotional journeys - feeling vulnerable, insecure, or even in pain - when they need some sort of mouth rehabilitation. “It feels like we’re changing lives,” he says.

One of the most impactful projects Tye worked on was for a patient undergoing treatment for breast cancer. The mother of two children finally got the status she was in remission and thought she finally gets to fix her teeth which she’s always been wanting to do. “It’s amazing seeing their reaction. It’s powerful to be part of their journey.”

Tye moved from Australia to London 4 years ago, but he didn’t just take his business with him - he expanded it. As his clientele has grown, he’s hired freelancers to help him shoot and edit, allowing him to do business in both the UK and Australia. He now has clients in Birmingham, Manchester, and London, as well as in Brisbane, Sydney, and Melbourne. He also occasionally contributes to international projects with high-profile clients based in the US.

As he’s scaled, his business, 230 Media, has grown into a boutique video production agency dedicated to crafting compelling brand narratives for businesses around the world.

Running 230 Media hasn’t come without its challenges. Tye often finds himself working around the clock to accommodate different time zones, handle various currencies, and juggle client calls in the early morning and late at night. “When you run your own business, you don’t really have personal time - it’s all work, all the time,” he admits.

Because of the time difference, he wakes up at 5 a.m. to manage business in Australia before the end of their workday. “I know there are a lot of shoots happening while I’m asleep, so I need to make sure everything is set up,” he explains. “And then, when the Australian side of the business wraps up, I have the UK operations to worry about.”

Beyond the demanding schedule, managing finances efficiently has been crucial. Tye relies on accounting software synced with his Wise Business account, which helps him track expenses and streamline invoicing. “Having a good accounting system in place is essential,” he says.

As Tye started out as a freelancer and gradually built 230 Media into a production agency working with global clients, he structured his payment process to offer flexibility. “Some clients pay per project, while others are on retainers,” he explains. “I try to keep it simple and transparent, so they know exactly what they’re paying for.”

When it comes to getting paid, having options matters. “I take bank transfers, card payments, and now use Wise Business - which has made a massive difference. Before Wise, I was constantly checking when payments would clear. Now, it’s quick and hassle-free.”

As 230 Media grew, Tye found that traditional banks weren’t built for the way he needed to run his business. Paying international freelancers and receiving client payments in multiple currencies meant dealing with slow processing times, poor exchange rates, and unnecessary fees.

“I’ve been with Wise Business for five or six years now. I manage multiple currencies, and when I was searching for a business account, Wise stood out. It was the quickest, easiest, and probably the best one to use.”

With Wise Business, clients can pay in their local currencies, and Tye can pay his overseas freelancers with transparent fees and mid-market exchange rates. “I use Wise to transfer money between countries - it’s a really easy solution for every stage of running a business.”

He also uses features like auto conversion. “I don’t have to constantly look for the best rates. I just set the rate I want, and Wise takes care of the rest.”

“I use Wise Business in the UK to pay most of my contractors, whether that’s in GBP, USD, AUD or NZD. They send me an invoice, and I just wire the money through Wise. It’s super easy - I just pop in their sort code and account details, and off it goes.”

Looking back, Tye reflects on the biggest lessons he’s learned since starting 230 Media - and what he wishes he’d known earlier. “I wish I knew how important cash flow management was,” he says. “You think making money is the goal, but managing that money properly is just as important.”

Another key insight? The value of surrounding yourself with the right people. “Find people who are smarter than you and who’ve done it before,” Tye explains. “I learned a lot the hard way, but having mentors has made the journey a lot smoother.”

Relocating from Australia to London came with its own challenges - personally and professionally. “Being an expat in London was really hard, to be honest. It’s a bit cliquey. You can’t just send out an email and land a job - you’ve got to really get to know people,” he says. “But once you start building that network, things start to snowball. You get one client, then two, and it just grows from there.”

Even adjusting to the day-to-day differences took time. “I’d see something like a meal deal for £3.50 and think, ‘That’s pretty cheap,’ but then realise it’s about $6 or $7 in Australia. As an expat, getting used to different currencies and cost of living is definitely a shift.”

Setting up financially in the UK wasn’t straightforward either. “Building a credit score was actually really tough,” he recalls. “I started off at around 200, and now I’ve managed to build it up to 800. But at first, I couldn’t even get a credit card. I had to sign up for this service where I paid £5 a month for six months just to qualify for a card with a £50 limit.”

Despite the challenges that come with running a business across multiple time zones and currencies, Tye has learned to navigate them by focusing on building strong networks, managing cash flow, and embracing the right tools to streamline operations. Wise Business has been a game-changer for Tye, simplifying the complexities of managing international payments and currencies. With transparent fees, fast transfers, and the ability to pay contractors in different countries with ease, it’s allowed him to focus on growing his business without the usual financial hurdles.

Get started with Wise Business

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

When Oksana Danyliuk and Serhii Kashevko left Ukraine in early 2022, they thought they were going on a short holiday to a remote island. Then the war...

For Garry Hurskainen-Green, borders have never been barriers - they’ve been invitations. As a seasoned entrepreneur with a background in IT, marketing and...

Backpacks are a common choice for travellers, including Sarah Giblin. However, while navigating crowded places like airports, train stations, or busy city...

Starting a business can feel like a daunting task at any age, but imagine becoming an entrepreneur after spending decades in a different career. Suzanne Noble...

In our increasingly digital world, education is evolving at an unprecedented pace, and platforms like are reshaping the way students learn...

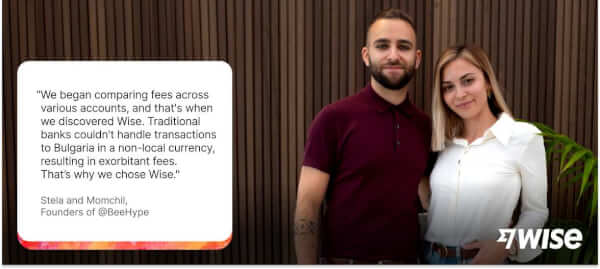

Discover how Wise business helped a customer to create buzz in the honey industry through smart financial management and innovative solutions.