Funding for international students in the UK: loans, funds, grants, and more

Read our essential guide to funding for international students in the UK, exploring loans, scholarships, bursaries, grants, awards and more.

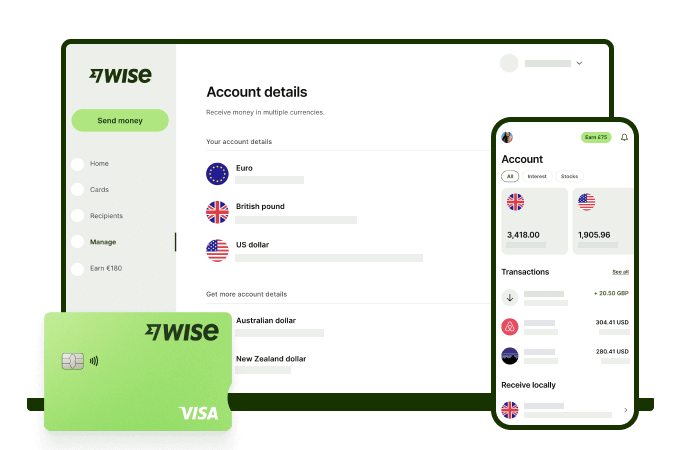

Wise is a way to move your money around the world, as easily as possible, for as little as possible. We’re building a better, cheaper, fairer system for anyone who lives, travels, or does business across borders.

With Wise, you should find that your fees are always fair*, and you get the mid-market rate. The same ones big corporations and banks get. But with Wise, you get those rates, too.

To see how to make your first transfer, read on.

Use our calculator on the Wise homepage to tell us how much money you want to send, and where you want to send it. You'll see our fees* and exchange rate upfront, even without logging in. So you can always check to make sure you’re getting a great deal.

Alternatively, why not try out our currency conversion tool below that can help you make an informed choice:

We use the mid-market rate. This means no margin or mark-up on the rate, which is what banks and other providers usually use to make a profit on currency conversion. Wise charges just a small, upfront fee for currency conversion*.

Some of our fees are as low as 0.33%*.

Like it so far?

It’s free to create an account with Wise and your recipient doesn’t need to use Wise for you to send money to them. You can sign up as an individual and, if you have a business, you can add your business to your Wise account – on desktop, mobile, or with our award-winning apps - android and iOS.

Depending on the country you're sending from, we might need to have you verified. Verification will take 1-3 days. Learn more about why you need to be verified.

Tell us who you’re sending the money to, along with their local bank details. You can send money to yourself, someone else, or a business, depending on the country.

Your recipient doesn’t need a Wise account to get their money. Just a bank account.

Pay by credit or debit card or make a local bank transfer to Wise’s account in your country. You don't have to link your bank account to Wise (unless you’re sending from Canada or the US).

Depending on the country you're sending from, you might have other payment options.

Our smart technology links local bank accounts in countries all over the world. So often we’re able to use money from a Wise user sending money the other way around. Once we get that sorted, we'll give you an estimate of when your money will arrive – usually it’s much faster than a bank transfer.

If you provide your recipient’s email address, we'll also give your recipient a heads up to let them know your money is on the way. It will go right into their bank account.

Ready to start sending?

If you have more questions, check out our smart Wise Help Centre or read some Wise reviews on Trustpilot to find out more.

Selling property overseas or transferring stock options? Transferring large sums with Wise is easy. And you'll avoid losing out to sneaky mark-up fees because Wise uses the mid-market rate. There's just a small, upfront fee for currency conversion.*

This means you lose less of your money in fees or hidden markups.

We believe your large transfer deserves dedicated support, too, and have an expert team on hand who are more than happy to assist or answer any questions. Find out more below or request a callback.

Once you have an account you can order a physical Wise card - there’s just a one-time fee of £7 to pay, and no annual subscription fees or hidden charges to worry about.

Simply open a currency account in one of the 40+ currencies available, and top up your account.

Learn more about the Wise card 💳

There's also the Wise digital card, which you can store virtually in mobile wallets like Apple Pay and Google Pay. Linked to your Wise account, this virtual card lets you spend in 150+ countries worldwide without having to carry a physical card with you - making it ideal for travellers.

Managing day-to-day expenses with a partner, family, or housemates is easy with ‘Spend with others’, our feature for shared finances and group spending.

It’s different from a joint account, it works as third-party account access that has one owner who controls the access and money along with one or more members who have limited access.

‘Spend with others' includes two parties: the Owner and the Member.

The Owner sets up 'Spend with others' and has full control over the money in the group, even if the money is added in by a group Member. The Owner gives them the ability to contribute money to the group and to get a card to spend from the group.

Both owners and members can spend money and see all transactions in the group but the Owner legally owns all the money contributed to the group.

It's available for personal customers in the UK, Australia, Brazil, the EU, New Zealand, Singapore and Switzerland but you can only use 'Spend with others' with someone who lives in the same country or region as you.

In the UK, you can have up to five people in a group. If you're registered in the EU, the limit is two people in a group. Currently, no matter where you are registered you can only be part of two groups.

Learn more: ‘Spend with others’

You can also manage shared finances with friends and family with our Split Bill feature. Say goodbye to awkward conversations and complicated calculations for everything from restaurant bills and travel expenses to monthly rent. This feature has been designed to make splitting costs transparent and hassle-free.

The true power of the Split Bill feature lies in its flexibility. You can split your transaction equally or unequally.

And you can easily divide expenses with both Wise users and those who haven't yet joined. Existing Wise members will receive a convenient in-app payment request notification to settle their share. For friends and family not on Wise, a simple payment link is generated for them to pay you back from their preferred bank account.

Young Explorer is the Wise card for kids. Currently available for Wise account holders that live in the UK.

It works in-store, online and at ATMs worldwide.

Now your whole family can spend and withdraw in the same currencies, at the same rates as you, with age-appropriate controls in place.

Inviting friends is key to the Wise revolution. The more people send money on Wise, the better it is for everyone. And you can earn real money when you refer friends who become Wise users. Invite 3 friends and earn up to £75. When 3 of your friends make their first transfer of more than £200, we’ll pay you up to £75 as a referral bonus.

Learn more about how our referral bonus works.

💡 Did you know... banks and brokers hide their fees on foreign currency transactions

This means that when you buy holiday money or make an international payment, the bank adds a hidden fee by offering you a poor exchange rate.

These hidden charges are on top of the stated charge, which is sometimes advertised as ‘free’ or ‘0% commission’.

Most people have no idea how much they’ve paid to access their own money.

Wise is campaigning to stop banks and brokers hiding their fees.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our essential guide to funding for international students in the UK, exploring loans, scholarships, bursaries, grants, awards and more.

How much are weddings abroad? Use this guide to understand what costs go into a destination wedding, and how to manage your budget.

Shopping online with overseas sellers? Understand your rights on refunds, returns and extra fees and spend globally with a Wise account.

Read our helpful guide to find out how to withdraw from your Royal London pension in the UK, and overseas if you’re retiring abroad.

Read our helpful guide to find out how to withdraw from your Aviva pension in the UK, and overseas if you’re retiring abroad.

Read our helpful guide to find out how to withdraw from your Nest pension in the UK, and overseas if you’re retiring abroad.