Sprout pricing and plans guide for the UK (2025)

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

When it comes to managing business finances, keeping an eye on cashflow is absolutely essential. You need to ensure a steady income stream, while also scheduling outgoing payments strategically.

In order to manage cashflow effectively (and meet payment deadlines), you’ll need to know how long payments typically take - for all the commonly used payment methods in the UK.

We’re here to help, with a complete guide to payment processing times in the UK. We’ll cover bank, card and electronic funds transfers (ETFs), along with international payments, cheques and more.

This includes average transfer times with Wise Business - a popular choice for UK businesses looking to send and receive international payments.

💡 Learn more about Wise Business

So how long does it take for a payment to process in the UK? The answer to this very much depends on the payment type used.

Take a look below for a rundown of the most common payment types used by UK businesses and their customers.

Bank transfers are among the most common payment types made by UK businesses, especially for day-to-day transactions between businesses. They’re used for paying suppliers, bills and other business to business (B2B) invoices.

Both BACS (Bankers' Automated Clearing System) and Faster Payments are commonly used. Faster Payments may just have the edge - as research by UK Finance found that 45% of all business payments in 2023 were made via Faster Payments, overtaking BACS at 31%.¹

BACS offers higher limits and offers time for amendments (within limits), although it is of course much slower than Faster Payments - which can be processed nearly instantly.

Business bank accounts may also charge different fees for BACS and Faster Payments, which may affect which one a company chooses to use.

Clearing House Automated Payment System (CHAPS) payments are most commonly used for large, time sensitive business payments. They do have higher fees than regular BACS payments however.

Card acceptance is on the rise across businesses of all sizes, as they aim to make it as easy as possible for customers to make a purchase. This does mean additional costs, including debit/credit card payment processing fees, website checkout integration costs and the charges related to getting and using PoS terminals to accept contactless payments in person.

Cheques are far less commonly used in the UK these days, although they do still exist in certain parts of the business world. The good news for cheque users is that processing times are far quicker than it used to be, as all GBP cheques are now processed using the Image Clearing Scheme.

When businesses need to send money abroad using their bank, the payment will be sent via SWIFT or SEPA - depending on the recipient’s location.

Transfers sent in euros (EUR) to a bank account located in Europe will be sent via SEPA. This stands for Single Euro Payments Area, and it includes a total of 41 countries including all EU member states. The system was designed to facilitate seamless electronic payments in euros across Europe.

For funds sent in non-EUR currencies or to a destination outside of the SEPA zone, SWIFT will be used instead. This stands for Society for Worldwide Interbank Financial Telecommunication, and is a global messaging network that allows banks to send and receive information about financial transactions.

While it may depend on the bank, SEPA payments are usually cheaper and faster than SWIFT.

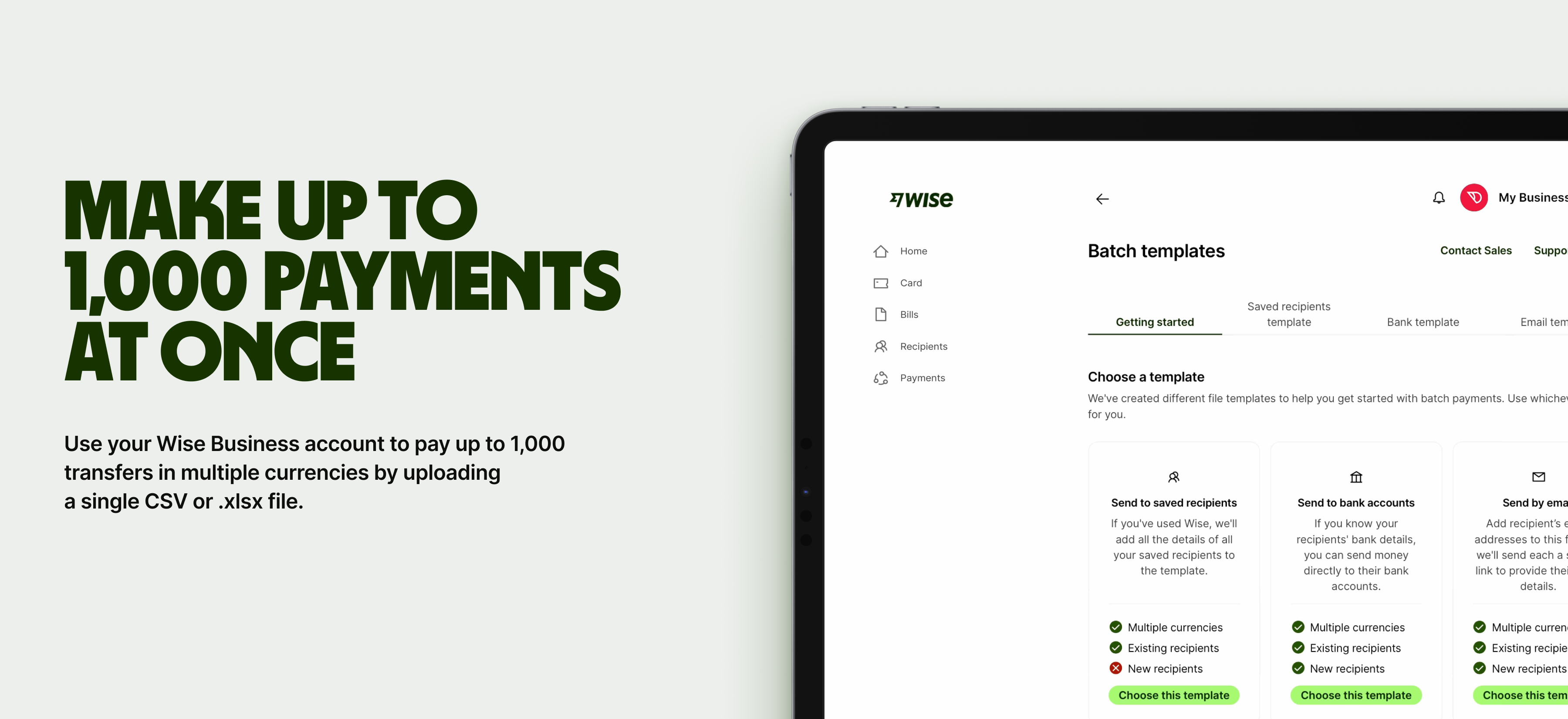

Another way for businesses to send money - especially between countries - is an electronic funds transfer (EFT) with a non-bank provider. A prime example is Wise Business, which isn’t a bank account but can be used to send secure, cost-effective payments worldwide.

💡 Learn more about Wise Business

EFTs sent with Wise and some other providers can often arrive much more quickly than bank-processed international transfers, as they avoid the SWIFT system.

Now, let’s take a look at average payment processing times, so you can plan your payment schedule and manage your cashflow effectively.

Remember though that the actual processing time may depend on the provider, and there are also some factors that can delay payments - we’ll look at some of those shortly.

| Payment method | Cut-off time | Average processing time² |

|---|---|---|

| BACS | Varies by bank, usually end of the working day | 3 working days |

| Faster Payments | N/A | Up to 2 hours (many payments within 2 minutes) |

| CHAPS | Varies by bank, usually between 2pm and 5.30pm | Same day |

| International bank transfer - SWIFT | Varies by bank, usually between 2pm and 5pm | 1 to 4 working days³ |

| International bank transfer - SEPA | Varies by bank, usually between 2pm and 5pm | Few minutes to 3 working days⁴ |

| Debit/credit card payment | Varies by card processor, usually end of the day | 1 to 3 days |

| Cheque | Varies by bank, usually 3.30pm or 5pm | 2 working days |

| Electronic funds transfer - Wise | End of the working day | 20 seconds to 2 working days⁵ |

There are a number of factors which can delay your transfer, whether your business is sending money or expecting a payment. It’s important to be aware of these, so you can avoid inadvertently making a mistake that holds up the payment.

Here’s what could potentially delay your payment:

If your company trades internationally, it could be worth checking out Wise Business.

Open an account and you can send fast, secure payments worldwide, for low fees and the mid-market exchange rate.

According to our data for Q1 2025, 64% of transfers were instant (completed in under 20 seconds) and 95% were completed in less than 24 hours.⁵

There’s even a dedicated service for sending large payments, along with specialist services for businesses including invoicing, accepting card payments and bulk payments.

You can also get local account details for major currencies within your Wise Business account, providing an easy and direct way to get paid by clients and customers in their own currencies.

Get started with Wise Business 🚀

It depends on the card processor, but it typically takes between 1 and 3 working days for card payments to be processed in the UK.²

Faster Payments is one of the quickest payment methods in the UK, with payments typically arriving instantly or within 2 hours. However, some electronic funds transfers can also arrive within seconds.

Some providers may offer ‘express’ payments services in exchange for an additional fee. Otherwise, you’ll just need to make sure you avoid delays by meeting the cut-off time and providing accurate bank details for your recipient.

Sources used:

Sources last checked on date: 19-Aug-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Learn about Hunter plans and pricing to find the right plan for your business and streamline your lead generation.

Learn how much tax you’ll pay as a UK sole trader in 2025. Our guide explains what type of taxes UK sole traders pay, when they have to pay them, and more.

Learn about Lumen5's pricing, plans, and features. Find the right subscription for your needs and get tips on how to save money on your account.

Learn how to set winning rates for social media management. Our 2025 guide covers pricing packages, retainers, and strategy to maximise your freelance income.

Unlock your earning potential with our freelance SEO pricing guide for 2025. Learn how to set profitable rates, factors that affect pricing, and more.