How to transfer large amounts of money to Brazil from the UK

Find out how to transfer large amounts of money to Brazil from the UK here in our guide, covering steps, fees, FX rates and more.

Need to send a large amount of money to India? You may need to put down a deposit on real estate property, send money to family or simply make a transfer to a local bank account in your name.

In either case, you’ll need to know the most secure and cost-effective way to send money overseas. We’re here to help, with a step-by-step guide to making large transfers to India from the UK.

We’ll also cover fees, exchange rates, transfer limits and everything else you need to know. This should help you set up your transfer to India in complete confidence.

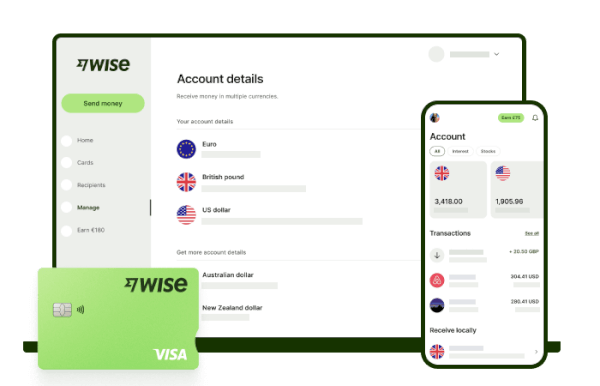

If you’re looking for a reliable and cost-effective way to transfer large sums to India, consider the money services provider Wise. With low, transparent fees*, great mid-market exchange rates, and secure, trackable transfers, Wise makes international money transfers simple and stress-free. Plus, you’ll receive dedicated support and volume discounts when sending large amounts.

Get expert support for your large transfer 📞

You have two choices for sending large payments overseas from the UK - you can use your bank, or you can sign up with a specialist international money transfer service.

The process of setting up and sending an international transfer should be similar for both options, and you’ll usually need the same recipient details.

Let’s run through the main steps involved.

First things first, you’ll need to make sure you have all the required details for your recipient and their bank.

Here’s what you’ll need:

You may also be asked to give a reason for the transfer.

**When using an online money transfer service, you can usually check the fees and rates for your transfer upfront **- along with other information like estimated delivery times. This is great, as it means you’ll know exactly what you’ll be paying.

It can be a little more difficult when using a bank. Some may offer a similar transfer calculator when you set up the payment in online banking. Otherwise, you’ll need to check the fees list for your account.

To see the latest exchange rates, you can check on the bank’s website or get in touch for more information.

Getting this information is important though, as you can use it to compare banks and providers, and get the best deal on your transfer.

Once you’ve chosen a transfer method, it’s time to set up your transfer. In most cases, you can do this online.

The only exception is if your bank has limits for international transfers carried out online. For example, Barclays has a maximum limit for online transfers of £50,000 (for personal accounts - the limits are higher for Premier or Business accounts).¹

To send a larger amount than this, you may need to visit a branch in person with your ID.

If you’re sending a payment online, you’ll simply need to follow the on-screen steps and enter the details of the transfer when prompted. This includes:

You may also be asked about who will be paying the fees. Banks often give you three options - the sender pays all the charges (OUR), the recipient pays/the amount will be deducted from the payment itself (BEN) or you share the charges (SHA).

If using a money transfer service, you’ll usually have to sign up for an account first. You can either link a bank account or top the account up with funds, then you’ll be ready to send your first transfer.

Once you’ve checked all the details carefully, you can confirm and send the payment on its way.

Need to send money to yourself? If you need to transfer money from your UK account to an Indian bank account in your name, you’ll need to follow the same process as above - just like with any other recipient.

Your bank may have daily limits on how much money you can send from online banking, although you can usually make larger payments by visiting a branch in person.

The limits for money transfer services tend to be much higher.

| For example, you can send up to 100 million Indian rupee (approx. £854,833 GBP) per transfer online with Wise.² |

|---|

When you send money to India using your UK bank account, your transfer will be sent via the SWIFT network. This means it can take anywhere from 1 to 4 days, although it could be quicker or slower than this.

It’s usually much faster with money transfer services, often only taking a day or two.

| 📚 Read more: How long do international bank transfers from the UK take? |

|---|

It should be safe to send money to India - even large amounts - as long as you use a registered UK bank or a regulated, reputable money transfer service.

Just make sure you do your research and make absolutely sure the provider or website is legit.

You should also take common sense precautions to protect yourself, such as checking recipient bank details carefully when entering them and not sending money to people you don’t know.

When it comes to sending money internationally, there are nearly always fees involved.

Let’s take a look at the kinds of charges you can expect when making a transfer to India from the UK.

Both banks and specialist transfer services tend to charge international transfer fees. These may be a fixed amount (usually the case with banks) or vary depending on the destination, currency and amount.

You can pay this fee separately, or add it to the amount you’re sending.

When you send money with a bank, it will be sent via SWIFT. This is a network of worldwide banks, who communicate with each other to send and receive transfers.

SWIFT transfers don’t always go straight from A to B - it’s often the case that multiple banks are involved along the way. And they may each charge their own fee, as may the receiving bank in India.

You’ll need to ask your bank about these correspondent/receiving bank fees, as info may not be available upfront.

Alongside money transfer fees, you also need to factor in the exchange rate for converting your British pounds (GBP) to Indian rupee (INR). This will affect the overall cost of your transfer more than you think.

Money transfer services usually show you the rate you’ll get before you send. With banks, you may need to check in your online banking or on a separate page of the bank’s website.

How do you know you’re getting a good deal? Always compare the rate you’re offered to the mid-market exchange rate, to see how much of a markup the bank or provider has added on top.

Exchange rates fluctuate all the time, so timing is crucial in order to get the best possible rate on your transfer from the UK to India.

To find the perfect time to send your transfer, you can sign up for exchange rate alerts.

Looking for a secure, convenient and low-cost way to send large sums of money to India? Take a look at the Wise account from the money services provider Wise. It's not a bank account but offers some similar features and your money is safeguarded.

With Wise, you can send large amount transfers worldwide to 140+ countries for low, transparent fees* and you get the mid-market exchange rate with no markup.

| Here’s an overview of the main benefits of using Wise: |

|---|

|

**Capital at risk. In the UK, Interest and Stocks are provided by Wise Assets — this is the trading name of Wise Assets UK Ltd, a subsidiary of Wise. Wise Assets UK Ltd is authorised as an investment firm and regulated by the Financial Conduct Authority (FCA). Our FCA number is 839689. We do not give investment advice, and you may be subject to pay tax. If you're not sure, seek qualified advice. You can find more information about the funds on our website.

Sources used:

Sources last checked on date: 6-Aug-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find out how to transfer large amounts of money to Brazil from the UK here in our guide, covering steps, fees, FX rates and more.

Looking for graduation money gift ideas? Here are physical and digital options for gifting or sending money to a graduate.

Compare PayPal vs. Wise for consumers in our comprehensive guide, covering fees, features, exchange rates and more.

Read out complete guide to Wise transfer limits in the UK, plus Wise limits for receiving, spending and withdrawing money.

Find out how to make a payment to an international bank account, including the details you'll need, steps and how long it takes.

What’s the quickest way to transfer money internationally? Find out about speed and average delivery times for leading transfer providers, including Wise.