Best international payroll providers in 2025

Learn about the top international payroll providers, their features, pricing, customer reviews and how to choose the right provider for your business.

If your business is successful here in the UK but it seems to have hit a ceiling, it could be time to think about international expansion.

Entering a new foreign market could open up a world of lucrative opportunities, and could be the ideal next step for your company. But it’s also a path that is fraught with challenges and costs, so you’ll need to be fully prepared

We’re here to help, with the ultimate guide to international expansion for UK companies. We’ll cover everything you need to know from types of expansion models to drawing up a strategy for success, as well as what obstacles you can expect to face along the way.

And while you’re gearing up for global domination, make sure to check out Wise Business. It’s a powerful international account suitable for companies of all sizes, especially if you have big plans to go global.

Go global with Wise Business✈️

There are lots of compelling reasons to consider expanding your business internationally, such as:

| Benefits |

|---|

|

We’ll look at each of these in a little more detail below.

A new country or even a continent means a whole new customer base to tap into. This is of course if you’re able to meet local demand, stand out from the competition and develop a tailored marketing plan to appeal to your new target market. It could mean potentially millions of new customers, giving you a chance to expand your reach and increase market share.

If you’ve reached a ceiling in terms of revenue in your home country, it could be time to expand abroad. With access to new markets and customers, the chance to grow and potentially diversify your product offer, you could significantly boost annual income and revenue.

Putting all of your eggs in one geographic basket (i.e. the UK) is never considered to be a solid risk diversification strategy. By expanding abroad, you can reduce your dependence on just one market and make your business more resilient. If there’s an economic downturn in one region, it’s good to know you have strong performance in another to balance and stabilise the business.

Establishing your company in multiple companies offers a way to become a trusted global brand. A global presence can boost your brand visibility, reputation and credibility, helping you to build consumer trust in every region you operate in.

Entering a new foreign market doesn’t just mean access to new customers - it also means access to a large and diverse talent pool. You can tap into skills and knowledge to help your company innovate, improve and thrive in its new environment.

There are certain economies of scale you can benefit from as a global business, especially in terms of production volumes and distribution networks. If you can find ways to make your processes efficient, especially when it comes to supply chains, you could make significant cost savings.

There may also be other financial advantages, such as tax benefits for businesses in some countries.

If you move into a market where competition in your niche is less intense than back home - and you get there first - you could benefit from something known as ‘first mover advantage’. This helps you to hoover up market share, establish a strong presence and gain a competitive edge, before any of your rivals start moving in.

| 💡 Explore our guides to doing business in Asia, LATAM, the U.S and Europe✈️ |

|---|

While there undoubtedly are a lot of benefits that come with global expansion, there are also plenty of pretty high hurdles to overcome. Entering a new market can be tough, expensive and time-consuming.

Typical challenges include the following:

We’ll look at these in more detail below.

If you’re moving into a country where English isn’t widely spoken, you may need to brush up on your language skills - or set aside some budget for translators.

The culture may also be quite different than you’re used to in your home market. Consumers may have different preferences, pain points and demands, and etiquette in the business world may also take some getting used to.

You’ll need to do extensive research and work with local partners to gain insights into your new market. You’ll need to tailor everything from products to marketing strategies to the new location, otherwise you could miss the mark.

You’ll need a solid legal team if you’re expanding abroad, as the regulatory landscape may be quite different than it is back in the UK. You may face lengthy legal and bureaucratic processes, mountains of extra paperwork and incredibly complex tax arrangements, with harsh penalties for non-compliance.

As a business owner launching in a new country, you may well be impacted by changes in government policies, conflicts, political unrest or localised economic instability - with everything from inflation to currency fluctuations affecting your bottom line.

You can’t always predict these, but you can be as prepared as possible with risk assessments, contingency plans and expert advisers on your team.

Launching a business in a new country essentially involves starting from scratch. This means high upfront costs, from registering a business to finding office space and hiring employees.

Not all countries have a great track record when it comes to unethical business practices and corruption, as well as robust enough protections for intellectual property. These can all pose serious risks for your business, so you’ll need to do your due diligence when choosing which markets to expand into.

Managing business funds between multiple currencies can be difficult and complicated, with risks to both revenue and profitability.

You’ll also need to find secure, cost-effective methods for making and receiving international payments.

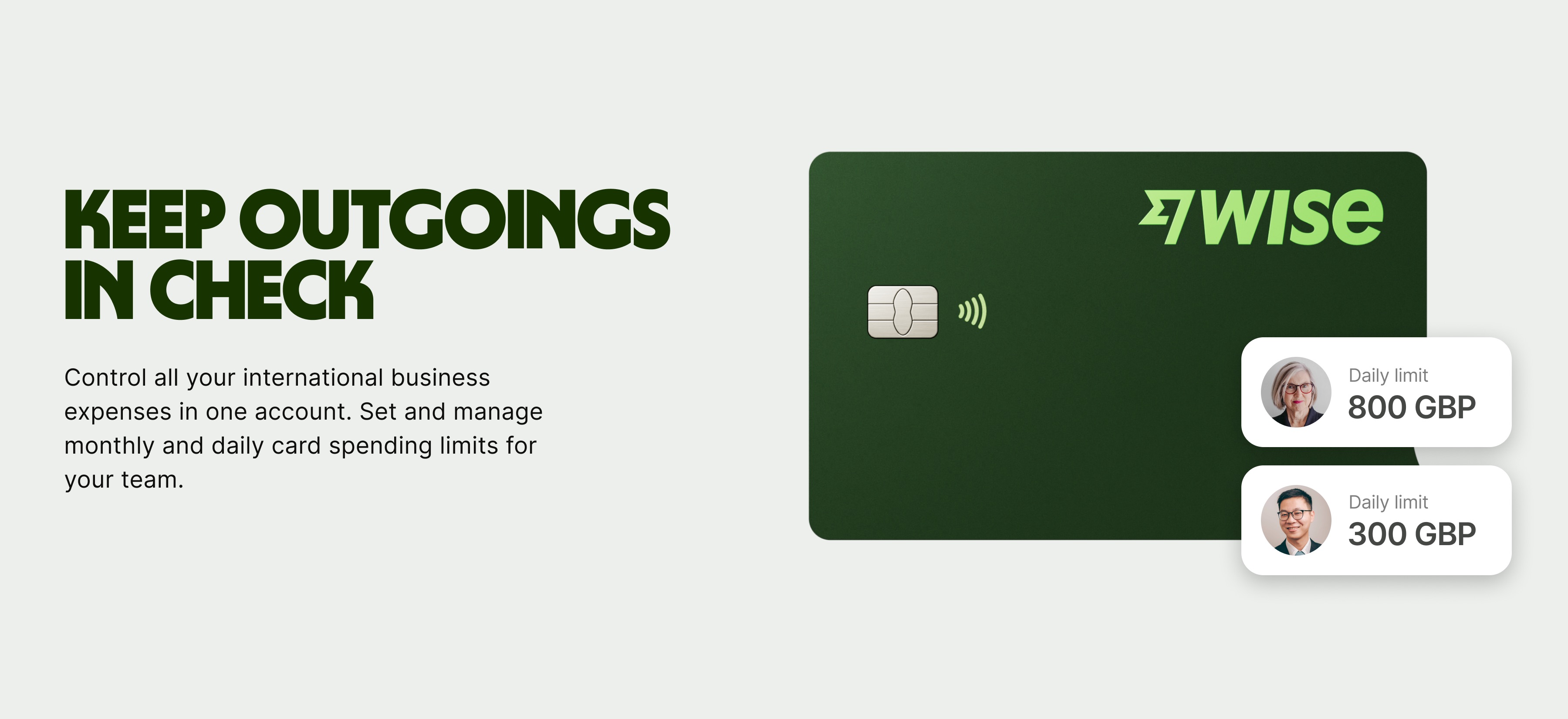

A Wise Business account is ideal for this, as it’s specially designed for international businesses. You can manage 40+ currencies all in one place and send secure payments worldwide for low fees and mid-market exchange rates.

"

"

"

A crucial mistake you can make as a business owner is expanding too quickly, before you’re ready. If you stretch things too far, too soon - you could face problems further down the line.

That said, it’s never too early to start thinking about and planning for international expansion. Having an eye on this as a key future goal can help you make smarter strategic decisions as you grow your UK business.

There’s no hard and fast rule for the perfect time to expand internationally. But you will need a few key things in place:

The more you can plan, the better prepared you’ll be. This may mean it takes an extra year or so to get your strategy in place, but it could give you a stronger platform for success when you do launch overseas.

| 💡 Learn more about navigating risks of international expansion |

|---|

International expansion isn’t a process you can rush. It’s important to plan and research in as much detail as possible, creating a watertight strategy that you can follow in order to reach your goals.

Let’s run through the key stages of developing an international expansion strategy, step by step.

The first step is to decide on an expansion model. Here are a few of the most common:

The next step is to draw up a timeline for your expansion, setting short and long-term goals along the way. This helps keep your plans on track, with a structure and clear direction to follow. Make sure your targets pass the ‘SMART’ test - specific, measurable, attainable, realistic and time-bound.

The key to success when expanding internationally is market research, and lots of it. You need to understand your new customer base, demand, local competitors, the socio-political landscape in the country and many other key factors.

Work with local experts and make use of local talent wherever you can, taking advantage of as much help, advice and support as possible.

You’re going to need third-party suppliers and services to help you succeed. For example, you may want to outsource marketing, PR or legal services to a local company with specialist local knowledge. You’ll need to start building this network of partners at an early stage.

While you’re working on your strategy, you’ll also need to start getting some essentials ticked off your list. This includes:

| 💡 Explore our international expansion checklist |

|---|

While you put your international expansion plans into action, you’ll also want to make sure you’re set up with the right business account.

Open a Wise Business account and you can hold and exchange 40+ at once.

You can send fast, secure payments to 140+, and get account details to get paid in 8+ like a local.

Whenever you need to send, spend or exchange foreign currencies, you’ll benefit from the mid-market exchange rate, with low, transparent fees.

You’ll also benefit from all of these features with Wise Business:

With a truly global account, you’ll be all set to grow your business worldwide.

Get started with Wise Business✈️

Sources used: N/A

Sources last checked on date: 30-Jul-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the top international payroll providers, their features, pricing, customer reviews and how to choose the right provider for your business.

Here’s an objective review of the best corporate tax software for International Businesses. Learn about their features, prices and ratings.

There are several reasons why international investment is appealing to UK startups at the moment. With economic uncertainty prevailing, the impact of Brexit...

Digital Product Passports are reshaping EU trade. Discover what’s required and how Wise Business makes compliance more cost-effective.

Learn how to start a business in Mexico, focusing on opportunities and regulations to navigate for successful operations.

Discover the 10 best European cities to start or grow your business in 2025 with funding, talent, and speed you won’t find in the UK.