Sprout pricing and plans guide for the UK (2025)

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Setting up an online business in the UK? If you’re looking to sell products, services or even subscriptions from your website, then you might need to use a payment gateway.

A payment gateway can help to make checkout processes fast, efficient, safe and compliant. This benefits both you and your customers, and could lead to more sales and increased revenue.

But how does a payment gateway actually work? Read this essential guide for UK business owners covering everything you need to know, including the benefits and fees involved in using a payment gateway. Plus, a quick rundown of some of the most popular payment gateways used in the UK.

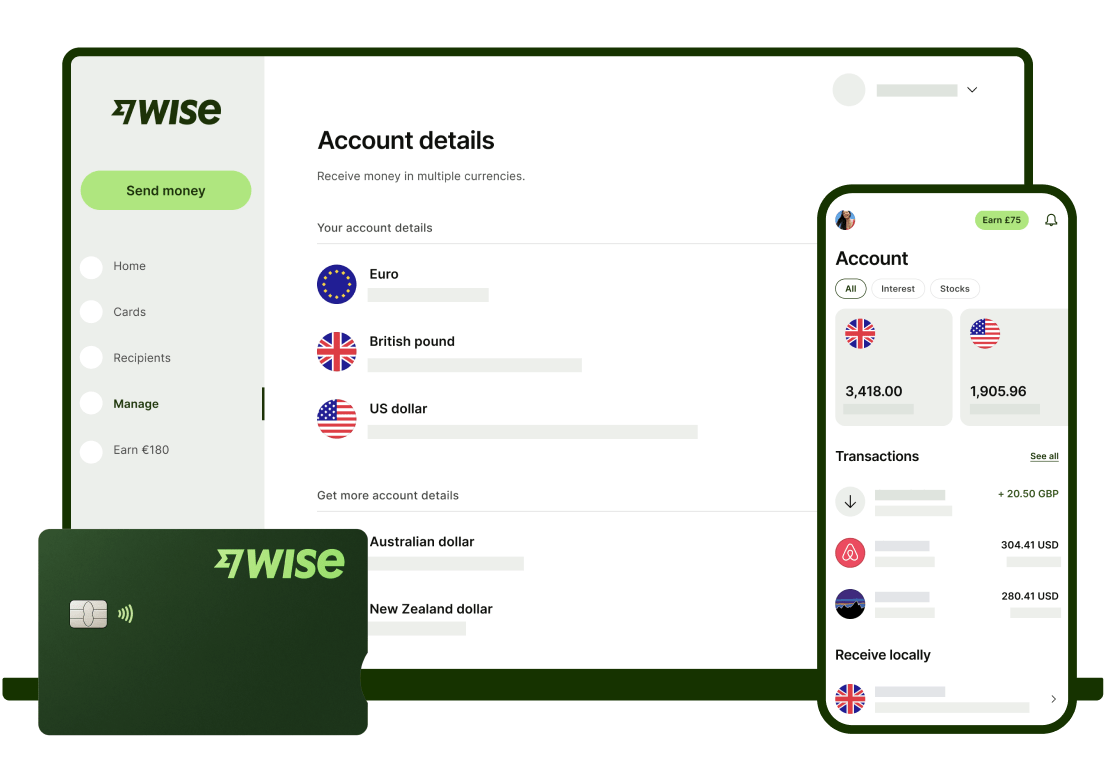

We’ll also show you an alternative way to get paid. With a Wise Business account, you can use invoices, QR codes and payment links as an easy way to accept electronic payments in multiple currencies from customers all over the world.

💡 Learn more about Wise Business

A payment gateway is a technology platform that plays a central part in online payments. It’s essentially an intermediary - or a middle man - between your website checkout or point of sale (PoS) system and the payment processor.

This service enables businesses which sell online and in person to accept and process card payments securely and efficiently.

There are actually lots of steps involved in processing a card payment (we’ll look at this in more detail shortly) and these can be complex and cumbersome to complete. A payment gateway streamlines and speeds it up, while also ensuring all compliance measures and authorisation processes are followed. This helps to prevent fraud, protect sensitive customer data and enable the fast processing of the payment.

It all starts with capturing customer payment details (such as their card details), before they’re transmitted to the payment processor and issuing bank for approval.

The main things a payment gateway does are:

Before using a payment gateway for the first time, it can be useful to understand exactly how they work - and the role they play in facilitating payments.

Here’s a step by step look at the whole process, starting with a customer entering their details on your website or PoS terminal:¹

The transaction is initiated

Your customer adds products or services to their basket on your website, then heads to the checkout page to enter their card details or authorise their digital wallet credentials. If taking a payment in person, the customer may tap their contactless card on a PoS terminal or enter it with a PIN code to pay for their purchase.

The payment gateway encrypts the data

Once the customer’s payment information has been submitted, the gateway encrypts it using either Secure Sockets Layer (SSL) or Transport Layer Security (TLS) protocols. This prevents it from being accessed, read or stolen during the transmission or other parts of the transaction.

The data is submitted to your business’s server

The encrypted payment information is sent to your server, which then securely stores it before forwarding it back to the payment gateway ready for the next steps of processing.

The transaction details are sent to the payment processor

At this stage, the payment gateway sends the still-encrypted payment information and transaction data to the payment processor your business uses. It’s also sent to the acquiring bank, which is your business bank account - this is the party ultimately responsible for processing and receiving the customer’s payment.

The transaction is verified

Your bank will then send the translation data to the customer’s issuing bank - this is the bank that issued their debit or credit card. Their bank will verify the details, including checking whether the payment method is valid and the customer has sufficient balance to cover the transaction. If not, the transaction will be declined.

The transaction is approved

If the customer is using a valid card and has enough balance to cover the payment, it will be approved by their bank. This authorisation is sent back through the chain the way it came - to the acquiring bank, the payment gateway and finally your business’s server.

The transaction is confirmed

The final step is for the payment gateway to send the transaction status to your website, app or terminal - which then displays the appropriate message to the customer. For example, ‘payment successful’ along with confirmation details such as an order number.

As you can see, quite a lot happens behind the scenes when a payment is processed - yet it only takes a few seconds in real time. This is partly due to the payment gateway, which ensures all processes and communications are completed quickly, efficiently and securely.

Payment gateways and payment processors are both essential for accepting and processing electronic payments, and they’re often confused for each other. But while they work together, they both play quite different roles in the process.

A payment gateway is an intermediary between your website checkout (or PoS terminal) and a payment processor. It doesn’t actually process the payment at all.

Its role is to facilitate all of the authorisation steps that need to happen for the payment to take place. This means encrypting and securely transmitting data, as well as communicating with all the key parties in the transaction. The payment gateway integrates with your website or app, or with ecommerce platforms or online marketplaces.

The payment processor is responsible for the processing of the payment. Its main functions include:

Payment processing providers usually provide businesses with merchant accounts, so that they can accept and process electronic payments.

In some cases, the same provider offers both services - a payment gateway, and a payment processor.

Read more about the cheapest online payment processing providers in the UK.

Most businesses which accept card payments or which sell online tend to use a payment gateway. There are very good reasons why this has become the norm. Without one, there isn’t a fully secure way a business can accept electronic payments.

Even if possible, the process would be slow, time-consuming, complicated for both customer and merchant, and at risk of errors due to the need for manual data entry.

Let’s take a look at some of the main benefits of using a payment gateway for online and in-person payments:

One of the main roles of a payment gateway is security. It encrypts sensitive customer information and facilitates anti-fraud checks including making sure that the person making the payment is actually the cardholder.

Payment gateways use features such as tokenisation, risk management solutions and other anti-fraud measures to add extra layers of protection. And for extra peace of mind, all payment gateways need to be PCI DSS compliant.

The better the payment experience is for the customer, the more likely you are to foster loyalty and repeat purchases. A fast, easy and convenient payment process is great for your business and your brand reputation, and a payment gateway can help with all of this.

Many payment gateways are set up to accept multi-currency payments, and are compliant with local payment rules in different countries. They can also handle the most popular payment methods used in countries worldwide.

This makes it easy for your business to start selling to a global audience, which is ideal if you have international expansion in mind.

Read more about how to accept international payments with a Wise Business account.

Payment gateways are not generally free to use. They come with multiple fees and charges, including:

To give you an idea of how much you can expect to pay to use a payment gateway as a UK business, let’s take a look at fees with some popular providers.

Below are fees from Stripe, Square, PayPal, Revolut Business and GoCardless, including monthly fees, transaction fees, currency conversion charges and chargeback fees - this is when a customer disputes a payment and it needs to be refunded.

| Provider | Monthly fees | Online processing fees | Currency conversion fees | Chargeback fee |

|---|---|---|---|---|

| Stripe² | None | - 1.5% + 20p for UK cards - 2.5% + 20p for EEC cards - 3.25% + 20p for international cards | 2% | £15 |

| Square | £0 to £29 per month³ | - 1.4% + 25p for UK cards - 2.5% + 25p for international cards³ | Unavailable | None⁴ |

| PayPal⁵ | None | - 1.2% + fixed fee for UK cards - 1.2% + fixed fee + additional fee of up to 1.99% for international transactions | 3% | £14 |

| Revolut Business | £10 to £90 per month⁶ | - 1% + 20p for UK cards - 2.8% + 20p for international cards⁷ | - 0.6% for conversion above plan limit - 1% for exchanges at weekends⁶ | £15⁸ |

| GoCardless (Standard plan)⁸ | None | - 1% +20p for Uk cards - 2% + 20p for international cards | Mid-market exchange rate, powered by Wise | £5 |

If you want a simple, secure and cost-effective way to accept global payments, check out Wise Business. Open an account and you can start accepting payments in multiple currencies, from customers and clients all over the world.

There are lots of ways to get paid with Wise Business. Either send a payment link, invoice or a QR code to your customers, and let Wise handle the rest - ensuring timely payments and an improved cash flow.

This streamlined approach eliminates the technical challenges and time-consuming setup associated with traditional payment gateways, allowing you to focus on what truly matters: growing your business.

For easy B2B payments, you can create local account details in 8+ - so that clients can pay you in their own currencies.

Once the payment is done, you can manage multiple currencies effortlessly, all in one account.

Enhance your customer relationships and support your company’s global expansion with Wise Business, a payment solution that prioritises simplicity and efficiency.

Get started with Wise Business 🚀

Sources used:

Sources last checked on date: 17-Sep-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Learn about Hunter plans and pricing to find the right plan for your business and streamline your lead generation.

Learn how much tax you’ll pay as a UK sole trader in 2025. Our guide explains what type of taxes UK sole traders pay, when they have to pay them, and more.

Learn about Lumen5's pricing, plans, and features. Find the right subscription for your needs and get tips on how to save money on your account.

Learn how to set winning rates for social media management. Our 2025 guide covers pricing packages, retainers, and strategy to maximise your freelance income.

Unlock your earning potential with our freelance SEO pricing guide for 2025. Learn how to set profitable rates, factors that affect pricing, and more.