Is euro accepted in Northern Ireland?

Discover if the euro is accepted in Northern Ireland and what are the payment options you have in the country.

Planning a trip or even a move across the border to Northern Ireland? As Ireland's closest neighbour it’s no wonder that so many people head over there, but while it’s just a stone’s throw away, Northern Ireland’s status as part of the UK means they use Pounds Sterling, rather than Euros. As a result, a little planning for your money is essential.

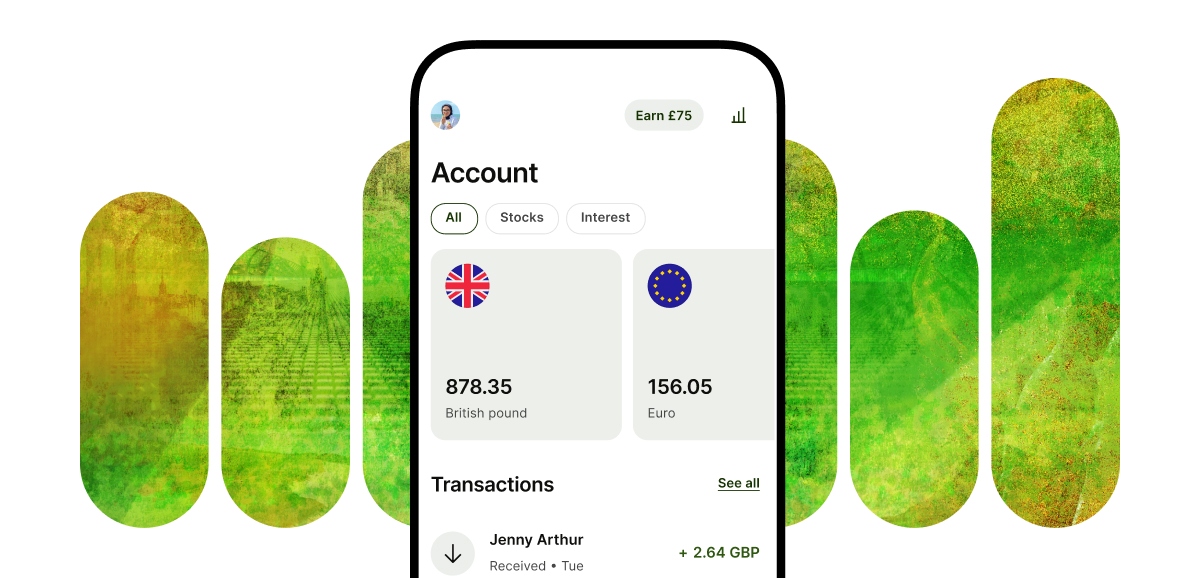

In this article we’re going to take a look at how Revolut works when you visit Northern Ireland, including what you can do, the fees you might face, and how it compares to Wise, another option for sending, spending and receiving money in GBP.

Irish Revolut accounts do work in Northern Ireland, meaning you’ll be able to make payments, send and receive money in GBP while there.¹

You can use your Revolut card to withdraw cash and make payments in person and online while in Northern Ireland.²

It’s also possible to use Revolut virtual cards to spend money online or in person via a compatible digital wallet, but they can’t be used to withdraw cash from an ATM.

Yes. When you open an Irish Revolut account there are a number of currencies that are supported for holding, including GBP, so opening a Revolut pounds balance is no issue.⁴

| Read more: Wise vs Revolut |

|---|

If you want to receive Pounds sterling from a UK based account it’s possible with Revolut because as an Irish account holder you have access to local GBP account details as well as EUR.³ To see your local details for any currency, simply follow these steps:

- Open the Revolut app and go to ‘Home’

- Select ‘Accounts’

- Choose the currency

- Look below the current balance and press ‘Details’

Having access to local account details can be extremely handy, which is why you also have them via the Wise Account. The difference is that Wise offers them in 7+ currencies than the two Revolut currently does, including EUR, GBP, USD and AUD.

When withdrawing cash and spending money abroad the fees can start to add up, so it’s sensible to be aware of what using your card outside of the Republick of Ireland is actually going to cost.

These are the main fees for using your Revolut card in Northern Ireland, and how it compares to the Wise card.

| Transaction type | Revolut | Wise |

|---|---|---|

| Card payments | Free up to a certain monthly limit based on your Revolut plan, then an exchange fee applies.⁵

| No transaction fee unless a currency conversion takes place, then a variable fee starting at 0.61% applies. |

| Cash withdrawals | A 1% or 2% fair usage fee after the monthly plan fee-free limit is exceeded.⁶

| Make 2 withdrawals of up to and including 200 EUR each month for free. After that, 0.5 EUR per withdrawal.* There’s a 1,75% fee on any amount you withdraw above 200 EUR. |

* ATM provider networks can charge fees when withdrawing money.

Spending money in Northern Ireland will likely involve converting Euros to Pounds sterling, so keeping an eye on the exchange rate is a smart move. After all, you want to get the most value out of your money, right?

Revolut uses a variable exchange rate which they state is calculated using data from multiple sources.⁷ You can find the current rates on the Revolut app or website for easy reference.

On the other hand, Wise always uses the mid-market rate, which is the rate you’d typically see on Google. This is the midpoint between the buying and selling prices on the currency market. Plus, Wise updates the rates at every minute, and there are no hidden fees or markups to worry about.

Yes. Since the United Kingdom, which includes Northern Ireland, is one of the supported countries it’s possible to open a Revolut account there.⁸

You will still need to meet the eligibility criteria, which includes needing to be a resident of the country you’re signing up from. The same case is for opening a Wise Account from Northern Ireland, for example.

When it comes to switching between Euros, Pounds sterling and other currencies, Wise offers a simple, cost-effective solution.

With a Wise Account, you can hold and exchange over 40 currencies and send money to more than 160 countries - United Kingdom included. Best of all, there are no account opening or maintenance fees to worry about.

You can also order a Wise card, which makes daily spending drama free. When spending in Northern Ireland the card prioritizes your British pound balance and, if needed, converts other currencies instantly using the fair mid-market rate. Then when you pop back over the border to Ireland, your Euro balance is prioritised, making your life just that little bit easier.

Open your personal

Wise Account for free 🚀

Sources used:

Sources last checked on date: 22 January 2025

Photos: K. Mitch Hodge via Unsplash

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover if the euro is accepted in Northern Ireland and what are the payment options you have in the country.

How does it work when you want to use your Irish Revolut account in the UK? Discover in this article.