Wise card vs Revolut card: Which one to choose in Ireland?

Choosing between cards in Ireland? Compare the Wise card and Revolut card features to find the best fit for your spendings and transfers.

More people than ever work from home, giving employers the opportunity to hire the very best from around the world - and allowing individuals to select projects and roles globally. If you’re a freelancer, self-employed person or work in an industry where remote work is common, maybe you’re thinking about working remotely for a Canadian company while living in Ireland.

This guide looks at remote working in Canada as an Irish citizen, including how to get paid and the types of jobs that are in demand.

We’ll also touch on how the Wise Account can help you cut the costs of receiving money in CAD, without needing to convert your income back to EUR every time if you’d prefer not to.

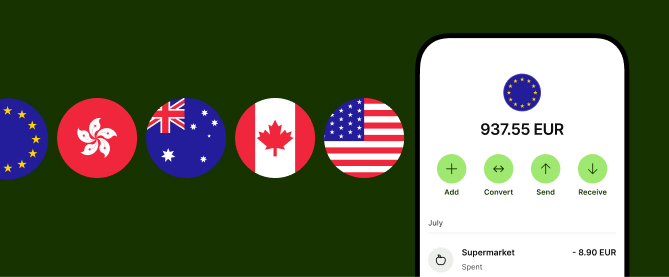

Wise: EUR and CAD

in one account 💰

Yes. You may be interested in working in Canada from Ireland if you’re in an industry which commonly accepts home and remote working, or if you’re a freelancer taking global projects. While remote working isn’t possible for every job, it’s increasingly common, and can open up many interesting opportunities.

Before you commit to working for a Canadian company overseas you’ll need to make sure you’re clear on your own obligations in terms of tax, and also your employer’s obligations.

If you’re taking up employment - rather than freelancing or working for yourself - your employer may need to register an entity in Ireland to be able to legally employ you. Make sure your prospective company has worked through their side of the legal requirements, to stay on the right side of the law. If you are in doubt, consult with a specialist.

It’s very likely that you will need to declare your income in Ireland even if you’re working for a company which is based in Canada. The key thing here is your tax residence.¹

If you’re viewed as a resident in Ireland from a tax perspective, you’ll need to declare your worldwide earnings in the country² - usually through the self assessment process.³

There are provisions in place which are intended to prevent any individual being taxed on the same income twice - usually in the form of tax treaties. Ireland has a double taxation treaty with Canada which is designed to mean you aren’t taxed by both Canada and Ireland on your income.

However, as with all things relating to taxes, the process can be relatively complex - and how the rules apply will depend a lot on your own personal situation. Take professional advice to make sure you declare and pay all your taxes properly.

Once you’ve got a position working with a Canadian firm, you’ll need to figure out how to receive your payments, which are likely to be made in Canadian dollars. You can either choose to have your salary or payments deposited to your bank in EUR, or you can use other providers like Wise to receive dollars with your local CAD account details.

Receiving a payment to your bank will usually mean that the bank itself manages the conversion of your CAD payment to EUR for deposit. This can involve paying fees which are built into the exchange rate used, as well as any applicable transfer, receiving or third party fees.

On the other hand, you can use your Wise Account to receive payments with local account information which lets you have CAD deposited to your account without conversion. You can then leave your balance as CAD, or convert to EUR or any other supported currency at your leisure - and with the mid-market rate (the same rate you normally see on Google).

Here’s a quick look at the associated key costs with Bank of Ireland, AIB and the Wise Account for receiving Canadian dollars, to illustrate the difference:

| Receiving CAD in Ireland | Bank of Ireland | AIB | Wise Account |

|---|---|---|---|

| Personal account fee | 6 EUR/month⁴ | 4.5 EUR/quarter⁶ | None |

| Incoming cross border payment fee | 5 EUR for payments over 65 EUR (or the equivalent)⁵ | 6.35 EUR for payments over 127 EUR (or the equivalent)⁷ | No fee for domestic payments 6.16 CAD for SWIFT payments |

*Correct at time of research - 24th March 2025

Bear in mind that the fees shown here for Bank of Ireland and AIB do not include any costs which have been incurred for currency conversion, or any third party fees which are deducted as the payment is processed.

You’ll need to ask the bank directly if you need to understand how any additional fees may apply when you receive payments from Canada to your account.

Open an account with Wise to hold and exchange 40+ currencies, and to help you cut the costs of managing your money across EUR, CAD and whichever other currencies you need.

Your Wise Account comes with local account information which you can use to get paid in 8+ currencies without needing to convert back to EUR. This is a convenient way to get paid as a freelancer or remote worker, and puts you in control of currency conversion.

Instead of being forced to convert automatically back to EUR every time, take your payment in the original currency and hold your balance as it is, or convert to the currency you need when you see a good exchange rate.

Wise uses the mid-market rate for currency conversion which helps keep down your overall costs, and means you can clearly see exactly what you’re paying when you send, receive, exchange or spend.

Need more? For ways to manage your money across currencies, why not also take a look at the Wise card to pay and withdraw money in 150+ countries.

Open your Wise personal account

for free 🚀

You can find a very broad range of remote job opportunities in Canada online, on popular recruitment websites like these:

If you’re looking for freelance gigs, you could also consider looking for positions and projects on freelance marketplace sites like Upwork and Fiverr. Finally, word of mouth and professional communication sites like LinkedIn are also great options for finding work in your field, in Canada or pretty much anywhere else in the world.

Some of the most commonly reported fields for remote work in Canada can include:

- Customer Support - including direct customer service staff, and more specialist positions

- Design - including product designers, UI designers, UX designers, brand designers

- Engineering - in particular developers and software engineers

- Marketing - with positions covering areas like content marketing, event marketing and social media marketing

- Operations - good selection of opportunities in positions like business analysts and project managers

- Product - look out for product design and management positions in Canada

- Sales - such as account managers and sales representatives working digitally and by phone.

Sources used:

1. Citizens Information - tax residence and domicile

2. Revenue Ireland - tax residence

3. Revenue Ireland - self assessment

4. Bank of Ireland personal fees

5. Bank of Ireland international fees

6. AIB personal fees

7. AIB international fees

Sources last checked on date: 24-03-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Choosing between cards in Ireland? Compare the Wise card and Revolut card features to find the best fit for your spendings and transfers.

Splitting bills with friends? Find out the best ways to divide costs fairly and easily, exploring Revolut features and another alternative.

What is the best CurrencyFair alternative in Ireland? Check out this list and see for yourself.

Curious about Revolut's exchange rate? We break down what you need to know to get the best value on your international payments.

This article is all about the safety of Wise card. Discover all the security measures you can add to your Wise account and card.

If you need to access the banking system in the USA, looking for Irish banks might be a possibility. Read this article to check your options.