Revolut vs Wise in Malaysia: Features, fees and availability

Learn more about Revolut and Wise, including exchange rate comparisons, and whether the product can be used in Malaysia,

Using a debit card to spend in person and online - and to make cash withdrawals at home and abroad - is convenient, safe, and often comes with relatively low overall costs. Unlike a credit card, there’s also no risk of accidentally spending more than you intend to, and getting hit with interest or penalty fees.

If you’re choosing a debit card, you’ll want to look at the card coverage, features and fees, to make sure you’re getting the perfect match for your needs. This guide walks through our top Malaysian debit card picks, split out by features and categorised to show what’s great about them.

| Table of contents |

|---|

Wondering - what is the best debit card for me? One great place to start is to think about how you’ll use the card once you have it. This guide walks through some of the more popular debit cards in Malaysia, including cards from major banks and specialist providers so you can answer the most important question: what is the best debit card for your specific needs?

More details coming up - but first, an overview.

| Card | Currencies covered | Fee to get a card | Maintenance fee | Foreign transaction fee | Virtual cards |

|---|---|---|---|---|---|

| Wise Card | Hold and exchange 40+ currencies | 13.7 MYR | No fee | No fee to spend currencies you hold in the account Currency exchange from 0.71% | Available |

| Maybank Visa Platinum Debit card¹ | MYR | 8 MYR | 8 MYR/year | 2% foreign transaction fee² | Not available |

| CIMB Debit Mastercard³ | MYR | 15 MYR | 15 MYR/year | 2% foreign transaction fee | Not available |

| PB Visa Lifestyle Debit Card⁷ | MYR | 8 MYR | 8 MYR/year | 1.25% markup on the Visa exchange rate | Not available |

| RHB Premier Multi Currency Card⁹ | MYR + 33 major foreign currencies | 20 MYR | 20 MYR/year | No fee to spend currencies you hold in your account (exchange rate markup may apply to convert from MYR) 1% markup on other currencies or if your balance is not sufficient in the particular currency | Not available |

| Hong Leong Debit Card¹¹ | MYR | 0 - 12 MYR depending on linked account | 0 - 8 MYR depending on linked account | 2% | Not available |

| HSBC Everyday Global Visa Card¹³ | 11 currencies | No fee | No fee | 1% | Not available |

| BigPay Card¹⁵ | MYR | 20 MYR | No fee | Up to 1% + network charges | Available¹⁶ |

If you're looking to withdraw cash from an ATM, whether it's in Malaysia or abroad, here are the fees associated with each Malaysia debit card:

| Card | Domestic withdrawals | International withdrawals |

|---|---|---|

| Wise Card | No fee for 2 withdrawals up to 1,000 MYR MYR/month 5 MYR + 1.75% after that | No fee for 2 withdrawals up to 1,000 MYR MYR/month 5 MYR + 1.75% after that |

| Maybank Visa Platinum Debit card¹ | Maybank withdrawals are free 1 MYR for out of network withdrawals | 12 MYR |

| CIMB Debit Mastercard³ | CIMB withdrawals are free 1 MYR for out of network withdrawals | Up to 10 MYR |

| PB Visa Lifestyle Debit Card⁷ | PB withdrawals are free 1 MYR for domestic out of network withdrawals | Up to 10 MYR |

| RHB Premier Multi Currency Card⁹ | 1 MYR for domestic withdrawals | 12 MYR |

| Hong Leong Debit Card¹¹ | HLB withdrawals are free 1 MYR for domestic out of network withdrawals | 12 MYR |

| HSBC Everyday Global Visa Card¹³ | 1 MYR for domestic out of network withdrawals | Up to 10 MYR |

| BigPay Card¹⁵ | 6 MYR for domestic out of network withdrawals | 10 MYR |

*Details correct at time of research - 22nd May 2025

Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

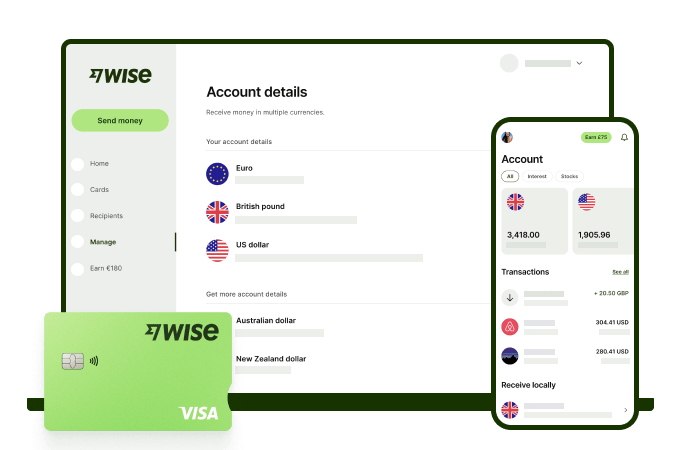

If you shop online with international retailers, or travel often, the Wise Account and card could be a great fit for you. The Wise card lets you spend in 40+ currencies at the mid-market rate including CNY, JPY, GBP, and SGD so you know you'll be getting a great deal in over 150+ countries. Simply create a free Wise account, order a card and top-up MYR to get started.

Virtual cards are free and can be added to your Google or Apple Pay wallet, while a physical Wise card can be ordered for a low fee of 13.7 MYR. Having a physical Wise card allows you to make chip and pin payments, as well as two free ATM withdrawals to the value of 1,000 MYR each month, before low fees start.

While abroad, you can choose to spend with directly in MYR and let auto-conversion do the trick, or convert to your desired currency with your Wise account. Either way, you’ll get the exchange rate you see on Google, with low, transparent fees from 0.77%.

Maybank has a comprehensive range of accounts and cards - as well as other financial products such as loans and credit. As Maybank is the largest bank in Malaysia, you’ll usually find it easy enough to locate a Maybank ATM - and local in-network withdrawals with the Maybank Visa Platinum Debit Card are fee free. Use your card internationally and you’ll pay a 2% foreign transaction fee which is made up of a 1% fee paid to the network and a 1% foreign conversion charge.

Order your Maybank Visa card by visiting a Maybank branch near you, and applying for a new account, or to add a card to your existing Maybank account. It’s worth noting that the account product you select may come with its own fees or minimum balances - so do check out the details thoroughly.

CIMB has both a standard debit Mastercard, and its Preferred card and account. The standard card comes with 15 MYR issuance and annual fees - and is available to customers aged 12+ with relatively few restrictions. The Preferred account is the CIMB high wealth option, and has quite restrictive eligibility rules.

The CIMB debit card has a 1% cross-border fee, plus a further 1% administration fee, which is applied on all overseas spending. This pushes up the costs when you travel, or when you spend online with foreign retailers.

The PB Visa Lifestyle Debit Card offers a range of evolving and changing lifestyle related promotions, like discounts on food delivery, birthday treats and more. There’s no joining fee for this card, but you’ll have to pay an annual fee of 8 MYR⁷ to keep the card active. In return you’ll be able to spend locally and internationally, and make in-network ATM withdrawals free here in Malaysia.

If you want a multi-currency account from a bank, the RHB multi-currency account and card is worth a look. You can hold and exchange 33+ currencies, with the RHB exchange rate, and then spend any currency you hold with no transaction fee to pay. There’s a 1% fee if you don’t have the right currency - or enough of the currency - in your account.

This account is also interest earning with rates set by currency. If you spend 3,000 MYR a year on the card you may find the annual fee is waived. Learn more about the RHB Multi Currency Card and account here.

HLB has a debit card which can be offered alongside a range of different accounts, from basic checking accounts, to standard and multi-currency account products. We’ve picked this out as a solid option if you want a card to be linked to a basic checking or saving account, as there’s no issuance or annual fee to pay in this case. You’ll still face a range of transaction fees - but this can bring down the overall costs of using the card, nonetheless.

You can open one of 3 different HSBC Everyday Global accounts, from the standard option which has no minimum balance requirement, to the Premier Account which requires you to hold 200,000 MYR or more in HSBC accounts. The higher tier account options also come with extra perks - but even the standard account lets you hold 11 currencies for easy global spending.

BigPay offers ewallet services and cards in Malaysia and Singapore. As well as using your card for spending and withdrawals, you may also be able to access budgeting and analytics tools to manage your money, send international transfers to select markets, and even apply for a personal loan.

BigPay cards can’t go overdrawn - you can only spend the money you add to your account in MYR in the first place, which makes this an option for MYR spending if you’re trying to manage your budget and can’t risk running into extra fees.

Read the full BigPay card review here.

The best debit card for you will depend a lot on your personal preferences and the types of transactions you make. Use this guide to the best debit cards for Malaysia as a starting point to weigh up a few of our top picks - and invest some time in what really matters to you while you choose your card.

You might like a card from a major Malaysian bank so you can access a broad range of products and services all from the same place. Or perhaps the Wise card is a great choice for you, if you travel internationally often, or like to spend online with foreign retailers. Wise can help keep costs low when you transact internationally, with no foreign transaction fees and the mid-market rate on currency conversion.

Sources:

| Learn more about Wise card benefits in Malaysia |

|---|

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about Revolut and Wise, including exchange rate comparisons, and whether the product can be used in Malaysia,

Want to know how much transaction fees you’re paying when using your Malaysian credit card overseas? Learn more about the types of fees and how to avoid them.

Learn more about how to use Lulu Money in Malaysia, as well as benefits, fees, and more.

Learn more about Revolut and Wise, including exchange rate comparisons, and whether the product can be used in Malaysia,

Learn more about the Maybank World Elite Mastercard in Malaysia, including benefits, requirements, fees and whether it’s worth getting.

See how the Maybank Global Access account compares with Wise including fees, features and more.