Airwallex NZ: Guide to business accounts, fees & global payments

Learn more about Airwallex in New Zealand. Our guide covers its all-in-one business accounts, products and features offered, and fees.

Launching a business gives you the chance to be your own boss, work flexible hours, pursue your passions, and achieve financial independence.

And it’s easier than you think. New Zealand consistently ranks among the World Bank’s “easiest places to do business”1 due to its streamlined online processes. As the World Economic Forum notes, the entire setup can take less than half a day.2

To make things even easier, we’ve compiled a guide on how to start a business in New Zealand. From a requirement checklist to costs, challenges, and best practices, we cover everything an entrepreneur needs to know.

| Table of contents |

|---|

Keen to kick off your next Kiwi venture? Here’s a checklist for starting a business in New Zealand.

Market research evaluates your customers and competitors to assess financial viability. First, analyse target audience demographics like location, gender, age, income, spending habits, motivations, and pain points.

Next, assess competitors to gauge market saturation. Do online sleuthing–Google Maps and Search–to see who you’re up against, and compare their strengths and weaknesses.

The larger the investment, the more you should allocate to market research. Big businesses hire third-party firms to conduct in-depth assessments. To DIY it, gather free data from annual company reports, trade publications, and Statistics New Zealand.

Leading Kiwi industries include agriculture, tourism, and renewable energy. You can still succeed in other sectors if your product stands out.

Every entrepreneur needs a business plan. The document paves a roadmap to success by clarifying your objectives, operations, strategies, milestones, and finances.

Unless you’re aiming for investors, it doesn’t need to be long. Many smaller businesses shoot for a succinct one-pager. Possible topics include a company overview, product definition, value proposition, business objectives, SWOT analysis, management, and financials.

Need a hand? See our business plan template or learn how to write a business plan.

| 👆Click here to read more about how to write a business plan |

|---|

New Zealand has three main business structures, each with distinct legal and financial obligations.

The Choose a Business Structure tool can help determine which works best for you.

Once you’ve chosen a structure, you can start registering your New Zealand business.

You may also wish to reserve a business name. The ONECheck tool determines whether a business name, web domain, and trademarks are already in use. If not, register them with the tool. Note that a registered business name doesn’t have to match your trading name.

While not obligatory, the New Zealand Business Number (NZBN) publishes key business information publicly to facilitate faster communication and build trust. Some businesses refuse to trade with those without an NZBN.

Companies automatically receive an NZBN during the registration process.7 Sole traders and partnerships must apply separately.

There’s no single, all-encompassing insurance policy covering all potential risks. Many businesses take out multiple policies to cover different things.

An insurance broker can help you identify risks and find suitable policies. Common policy types and what they cover include:

Hiring staff? You must comply with New Zealand Employment legislation. Key considerations include holidays, wage protection, parental leave, minimum wage, equal pay, and migrant protection.8 You can register as an employer through the IRD.9

New Zealand has strong intellectual property (IP) laws. Copyright applies automatically when producing content. Modest fees apply to registering a trademark or patent10, but it’s a small price to pay to safeguard your IP.

When collecting or using personal information, you must comply with the Privacy Act 2020. The data owners must know you’re collecting their data, why, how you will use it, and how it will be stored.11

You and your staff must possess the necessary certifications, qualifications, and licenses to fulfil your duties. From architects to engineers and accountants, qualifications are a non-negotiable for several specialised white-collar professionals. Many educators also need degrees, as do healthcare professionals.

Licenses are a must for electricians, plumbers, and gasfitters. Other trades may have their own specific occupational licensing requirements. Working on-site often requires a General Construction Induction (GCI), also known as a “white card.” Hazardous activities, such as operating cranes or working at heights, require advanced certifications.

Hospitality businesses must comply with the Food Act 2014. Follow the Sale and Supply of Alcohol Act 2012 if you plan to sell booze.12

A business communicating through email or SMS should take care not to breach the Unsolicited Electronic Messages Act 2007.13

All businesses must register with the IRD and pay tax on profits. Sole traders can use an existing personal IRD number, while partnerships need a new one. Companies register an IRD number during the incorporation process.14

New Zealand businesses typically file their first tax return as a lump sum at the end of the first financial year. Subsequent tax returns are often paid in instalments called provisional tax. Provisional tax is compulsory if you paid more than $5,00015 in tax on the previous return.

If you expect your business to turn over more than $60,00016 in the next 12 months, you must register for GST. Learn more about business tax rates in New Zealand.

Opening a business account streamlines bookkeeping by separating business and personal expenses. The best business accounts also integrate accounting software to minimise tiresome manual tasks, such as payment reconciliations and cross-checks.

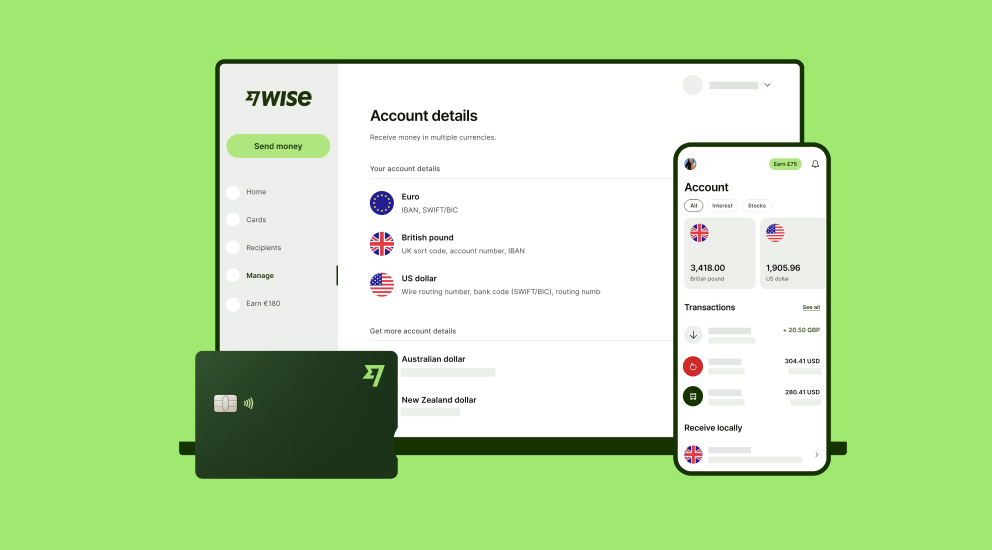

Banks offer a range of products to business customers, including business loans, corporate credit cards, insurance, payment solutions, and industry advice. If you’ll make frequent international transfers, you could benefit from an alternative service like Wise Business.

Sign up for the Wise Business account! 🚀

If you’re starting an online business, invest in a webpage, social media accounts, a payment gateway, an inventory management system, and other digital assets. Starting a business from home may require renovating rooms, setting up a home office, or upgrading your internet. A brick-and-mortar retail store, of course, requires a larger investment to lease and retrofit a shopfront.

In addition to low-cost transfers, Wise Business is a single-platform solution for bulk payments, handling invoices, issuing cards, and tracking expenses.

Registration is cheap. The sole trader and partnership structures are free, while registering a company costs $118.746 (plus GST). The fee for reserving a business name is just $10 + GST.17

But expenses stack up. Common one-time costs include real estate, permits, equipment, vehicles, retrofitting, furniture, branding, and web development. Ongoing expenses include insurance, utilities, wages, rent, stock, ingredients, and materials.

Once you’ve added up your projected expenses, slap on another 20-30% to cover unforeseen costs and price hikes. Expect to spend the first six months’ running costs to get your business off the ground.

Entrepreneurs can source capital from personal savings, business loans, or investors. If attempting the latter two, a detailed business plan is essential. Most lenders like to see real-world experience before approving a loan.

Government grants can help new businesses grow. Streams include support for Maori business owners and tech start-ups, as well as subsidised mentoring for all business types.18

While New Zealand is a relatively easy place to do business, trading here is not without challenges.

Starting a business in New Zealand is easy enough. Growing it is an entirely different matter.

As a first-time business owner, you can’t hope to understand the complexities of employment law, taxation, and compliance. A pro consultant can show you the ropes to make life easier and mitigate the risks.

Cash flow woes can see a finely-tuned business come unstuck. Gather a sizable reserve to save you from sticky situations while your business takes off.

Adaptation is essential for growth. Use accounting software to keep close tabs on your finances and determine where you can improve profits and slash expenses.

Keep a keen eye on what’s happening in your industry to stay abreast of the latest trends. Understanding consumer shifts and competitor behaviour can help you optimise your product and stay one step ahead.

Need to pay suppliers or staff situated overseas? Wise Business could save you a tidy sum. With low transparent pricing and coversions at the mid-market exchange rate, you’ll spend less on international transfers than what it generally costs.

Wise Business helps streamline overseas business payments without foreign transaction fees, saving up to 3x compared to other providers.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

1. How do I set up a business in NZ with no money?

Your best bet is to look for business ideas that don’t require much capital, such as pet sitting, cleaning, personal training, drop-shopping, and online freelancing.

2. How much does it cost to register a business in NZ?

You can register a company for just $118.746 (plus GST). Registering a partnership or sole trader doesn’t attract any fees.

3. How old do you have to be to start a business in NZ?

Partners in partnerships don’t have age requirements. Company directors must be 18 or over.

4. How do I open a business in NZ online?

After registering your new online business, build a web presence by investing in social media marketing and an SEO-optimised webpage.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about Airwallex in New Zealand. Our guide covers its all-in-one business accounts, products and features offered, and fees.

Comparison of Airwallex vs Wise for NZ businesses. Overview of difference fees, features, and usability to find the best fit for your business. Read here!

Learn what documentation you need to open a business account online, the steps you must follow, and which New Zealand banks offer online setups.

Learn what to consider when weighing up different payroll options. Compare some of the top payroll solutions for small businesses in New Zealand.

Looking for the right business banking in NZ? We compare products, fees, and services from top banks in New Zealand to help you choose the best fit.

Learn some of the leading online and offline marketing strategies for small businesses in New Zealand, from building a website to enhancing your presence.