ASB international transfer: Fees, rates, and transfer time

Thinking of transferring money with Westpac? Our guide breaks down their money transfer fees, exchange rates, and how they compare to Wise.

Revolut is a British fintech company that’s available to customers around the world, offering a range of financial services which are managed through their app. The company started 2015, and expanded into New Zealand during 2023.

In this guide, we’ll take a closer look at the products, features and fees Revolut offers New Zealanders. We’ll also compare it to Wise, so you can have a bit of context when deciding whether or not Revolut is the best option for your needs.

| Table of contents |

|---|

Revolut offers a digital platform where users can manage a wide range of financial activities, from everyday spending and saving, to investing, borrowing, and handling multiple currencies.¹ Everything is run through the Revolut app, which gives you full control of your account directly from your phone.

One of the core features of Revolut is the multi-currency account, and offers Kiwi customers a choice between 4 different account types for personal use. There are also options for business customers. All Revolut accounts hold 30+ currencies, and come with linked physical and virtual cards for local and international spending and cash withdrawals. The exact account features you can get will depend on the plan you pick, more on that later.

In New Zealand, Revolut is registered as an ASIC-Overseas company (NZBN 9429048733212), and a Financial Service Provider (FSP766191).¹ As a result, they have to adhere to the government regulations that allow them to hold this type of registration.

When it comes to app security, Revolut has several measures in place to protect your money and personal information.²

All of this tends to make Revolut a secure option for New Zealand customers looking for a digital financial experience.

With a Revolut account you’ll be able to manage your money across different currencies from one place. You can open an individual or joint account, and use it to send, receive, and hold funds. It also offers features to help you save and invest, all from within the app.³

At the moment Revolut has four plans available to New Zealand consumers:³

- Standard - No monthly fee

- Plus - $5.99 per month fee

- Premium - $11.99 per month fee

- Metal - $22.99 per month fee

With all of the Revolut account plans you have access to these features:⁶

- Exchange and hold 30+ currencies

- Send money to multiple countries around the world

- Send and receive money with other Revolut users in minutes

- Invest in commodities

- Access to virtual and physical Revolut cards

Account holders on the more expensive plans can also access additional perks like travel insurance, priority customer support and discounted airport lounge access.³

Moving on to the costs related to having a Revolut account, here’s some of the main fees to consider. You’ll notice that they vary depending on which Revolut plan you choose.³

| Fees | Standard | Plus | Premium | Metal |

|---|---|---|---|---|

| Monthly fee | Free | $5.99 | $11.99 | $22.99 |

| ATM withdrawals | $350 or 5 withdrawals per month free then 2% fee per transaction | $350 per month free then 2% fee per transaction | $700 per month free then 2% fee per transaction | $1400 per month free then 2% fee per transaction |

| Currency exchange fee⁴ | $2000 per month free then 0.5% fee per transaction | $6000 per month free then 0.5% fee per transaction | $20,000 per month free then 0.5% fee per transaction | No fee |

| Additional weekend currency exchange fee | 1% | 0.5% | No fee | No fee |

| International transfer fees | Variable fee depending on country and currency | Variable fee depending on country and currency | Variable fee depending on country and currency with a 60% discount | Variable fee depending on country and currency with a 80% discount |

Another key fee structure to keep in mind is the fees for the physical Revolut cards. Charges can apply depending on your chosen plan, the type of card (metal, plastic, custom), and whether it's a new or replacement card.⁴ On the other hand, Virtual Revolut Cards, like those from Wise, are free to create or replace.

Revolut uses its own variable exchange rate, which you can check directly in their app.³ While this rate can be competitive during weekdays, it's crucial to understand how it compares to the mid-market exchange rate – the true rate you see on Google, without any hidden markups.

A significant difference impacting your costs is the weekend. Out-of-hours fees of up to 1% apply on weekends depending on your plan and Revolut defines these weekend hours as Friday 5 AM to Sunday 6 PM, New York time.⁵ Keep in mind that this time could vary throughout the year when changed to New Zealand timezones due to daylight savings, potentially leading to unexpected charges.

For a consistently transparent approach that avoids these additional charges, Wise, another popular multi-currency account provider, operates differently. Wise applies the mid-market rate for all currency exchanges regardless of the day or time. Its low, transparent fees are always shown upfront, ensuring you know exactly what you're paying.

You’ll need to compare the overall currency exchange costs based on how you expect to use your account. Higher exchange fees mean your international spending costs you more, so choosing the account plan or provider which is cheapest for the types of transactions you’ll make often will help you lower your costs.

For those in search of a financial platform equipped with tools for managing money across borders, Revolut stands out as a solid choice for New Zealanders. On Trustpilot, it boasts a 4.5 star rating, with many praising the user-friendly app and convenience. That said, some customers have voiced frustrations over fees and the responsiveness of customer support.⁵

Before committing to a new provider, it’s smart to evaluate the strengths and weaknesses. Here are a few of the key upsides and potential downsides of opting for Revolut in New Zealand.

| Pros | Cons |

|---|---|

|

|

Revolut provides a versatile money app for New Zealanders aiming to handle their daily expenses, convert currencies and invest money, directly from their phone. With various plans, including the free Standard option, users can choose the one that suits their needs. So, if you’re comfortable navigating the varied fee structures and would like some extra perks like travel insurance or crypto trading, Revolut may be a good choice.

Alternatively, if you prefer a straightforward option for global spending with no monthly charges, no weekend exchange surcharges, and online as well as in-app access, Wise could be the way to go.

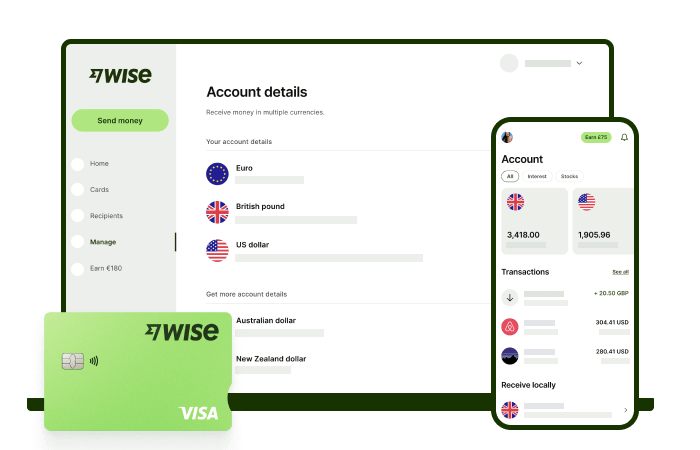

The Wise account is an easy way to save up to 7x when you send, spend, and withdraw money internationally. Hold and manage 40+ currencies, including NZD, USD, EUR, and more. All you need to do is sign up for a free account to get started, there's no monthly fees either.

You can exchange currencies at the mid-market rate on every conversion — basically the rate you see on Google. And with zero foreign transaction fees, and low, transparent pricing, Wise usually gives you the best value for your money.

You'll get 8+ local account details in NZD and a selection of other global currencies to get paid conveniently to your Wise account. And when it's time to send money abroad, enjoy fast, low-cost transfers to 140+ countries. Plus, you can get a linked Wise debit card for spending internationally at the same great mid-market rate.

When it comes to managing money globally, the Wise account is a handy tool that makes it easier and simpler.

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you. Savings claim based on our rates vs. selected New Zealand banks and other similar providers in Jan 2025. To learn more please visit https://growth-layer.live/nz/compare%3C/a%3E%3C/p%3E

Please see Terms of Use and product availability for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

Date: 22 July 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking of transferring money with Westpac? Our guide breaks down their money transfer fees, exchange rates, and how they compare to Wise.

Thinking of transferring money with Westpac? Our guide breaks down their money transfer fees, exchange rates, and how they compare to Wise.

A guide to opening a bank account in Australia from New Zealand.

A comprehensive guide for New Zealanders on the Air New Zealand Koru Lounge membership.

Deciding between OneSmart and Wise for your next trip? Our guide compares features, fees, and more to help you choose the right travel money card.

Wondering if the Cash Passport Platinum Mastercard is right for you? Our guide outlines all you need to know from features, fees, exchange rate, and more.