Your Wise Card Transactions: Understanding Invalid Disputes

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...

Visiting China? Good news! Even if you don’t have a local Chinese bank account, you can easily link your Wise card to Alipay or WeChat Pay. This means simpler currency exchange and seamless spending for overseas Chinese residents and foreigners travelling.

Using your Wise card for payments is not just quick and secure, it also offers real-time exchange rates and transparent, low fees. This can save you money compared to directly linking an international credit card, enabling you to use mainstream payment methods seamlessly in China. Both virtual and physical Wise cards can be linked.

Here’s a detailed guide on how to link your Wise card:

Open the Alipay app and complete real-name verification, which can be done using your ID card or passport.

Ensure your Wise card is activated. It's recommended to have a CNY balance in your Wise account, as payments will primarily be deducted from there.

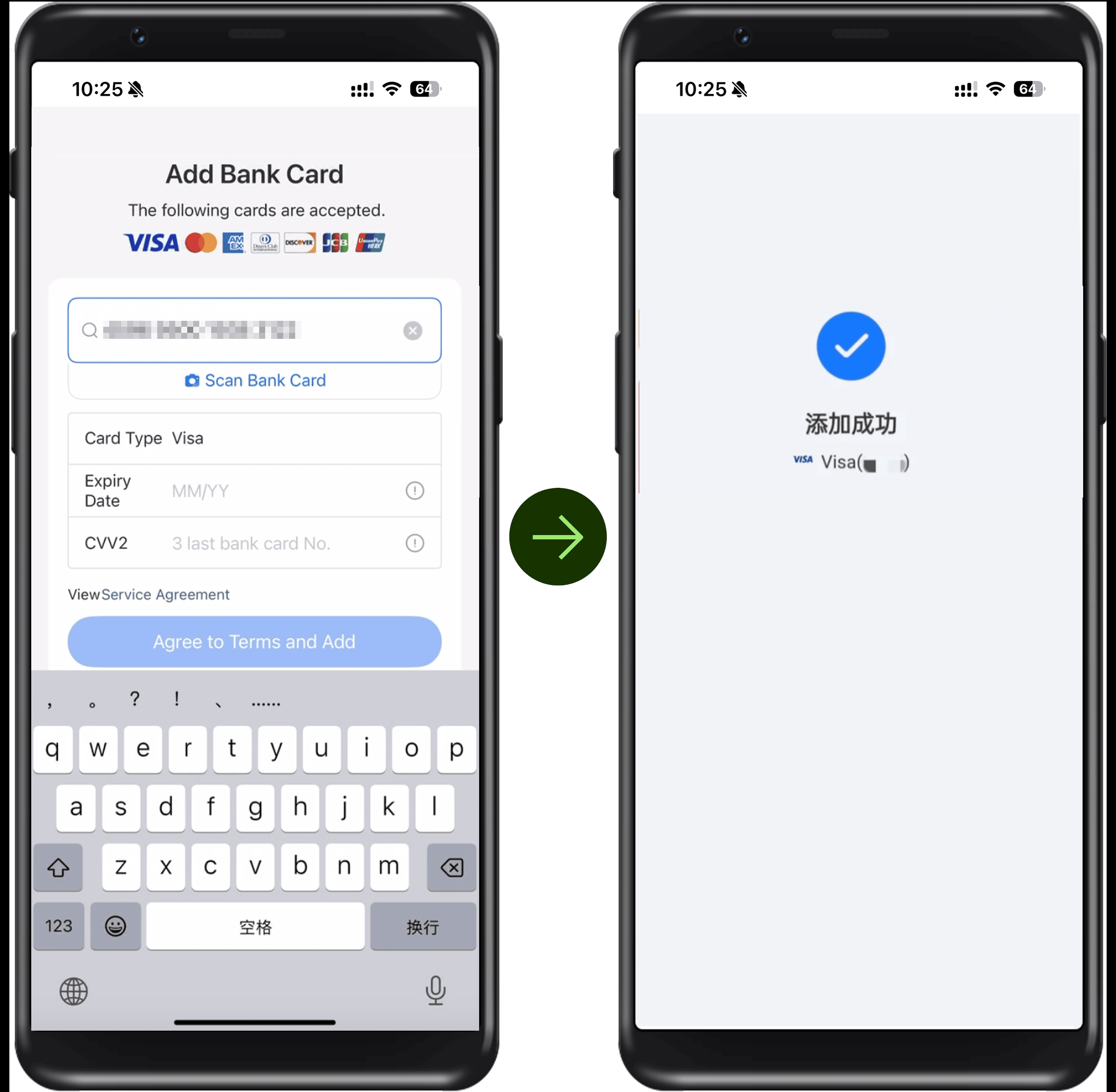

Add your Wise card in Alipay by navigating to: Me → Bank Cards → Add Bank Card.

Copy your Wise card number and card information into the bank card details page. Follow the steps to complete the information.

You'll see a "Successfully Added" message once it's done.

Keep these quick tips in mind for smooth transactions and to avoid any hiccups

If you don't have a Wise card yet, it's quick and easy to get one.

The Wise card lets you spend in 40+ currencies at the mid-market rate including MYR, JPY, CNY, and USD so you know you'll be getting a great deal in over 150+ countries. Simply create a free Wise account, order a card and top-up SGD to get started.

Virtual cards are free and can be added to your Google or Apple Pay wallet, while a physical Wise card can be ordered for a low fee of 8.50 SGD. Having a physical Wise card allows you to make chip and pin payments, as well as 2 free ATM withdrawals to the value of 350 SGD each month, before low fees start.

While abroad, you can choose to spend with directly in SGD and let auto-conversion do the trick, or convert to your desired currency with your Wise account. Either way, you’ll get the exchange rate you see on Google, with low, transparent fees from 0.26%.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...

Our mission is to lower the cost of moving money across borders. And since we started 13 years ago, we’ve made good progress, particularly over the past...

Discover how Wise compares to major banks and money transfer services, saving you up to 4x on international transactions.

Discover how Wise compares to 5 major Japanese banks and Revolut, offering savings of up to 6x on international transactions.

Discover how Wise outperforms 5 major New Zealand banks, PayPal, and Western Union, offering savings of up to 6x on international transactions.

Detailed research by Wise reveals substantial savings compared to Singapore banks and services like Instarem, Revolut, and Youtrip by EZ link.