How to Retire in Japan from Singapore: 2025 Guide

Retiring in Japan appeals to many Singaporeans because of its combination of vibrant cities, historic charm, and natural beauty. From bustling city life in Tokyo to the serene temples of Kyoto, Japan offers a lifestyle that balances modern conveniences with cultural richness.

However, retiring abroad involves more than just choosing a place. You need to consider visas, cost of living, healthcare, and how to manage your finances.

This guide will walk you through the essentials of how to retire in Japan, including your visa options, the best locations to settle, and how much to retire in Japan.

We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

Why retire in Japan?

While Singapore offers modern convenience and a high standard of living, Japan provides a more diverse cultural experience, scenic landscapes, and a slower pace of life that many Singaporeans find appealing for retirement.

Before retiring in Japan, it’s important to consider the advantages and potential challenges of doing so.

Pros

- World-class healthcare and safety

- Clean, efficient public transportation

- Rich culture, history, and natural scenery

- High standard of living

- Delicious and healthy cuisine

Cons

- High cost of living, especially in major cities

- Language barrier for non-Japanese speakers

- Limited visa options for retirees

- Earthquake-prone regions

- Smaller housing spaces compared to Singapore standards

What are the Visa options for retiring in Japan?

Unlike some Southeast Asian countries, Japan doesn’t offer a visa specifically for retirees. Singaporean citizens can enter Japan visa-free for up to 90 days, but anyone planning to live long-term in Japan must obtain a long-stay visa.

Depending on your situation, there are several visa options that can allow you to retire in Japan.

Designated activities (Long stay for sightseeing and recreation) visa

- Best for: Wealthy retirees seeking a temporary stay in Japan for leisure or exploration

- Eligibility: Applicants must be 18 years or older and have the necessary savings

- Financial requirements: Proof of savings equivalent to more than 30 million JPY (about 261,000 SGD)¹

- Period of stay: Up to 1 year

Business manager visa

- Best for: Retirees interested in entrepreneurship or managing a business in Japan

- Eligibility: Applicants need a viable business plan, a business license, and investment capital²

- Financial requirements: Applicants must invest at least 5 million JPY (about 43,500 SGD) in a new business or 2.5 million JPY (about 21,700 SGD) in an existing business³

- Period of stay: Up to 5 years⁴

Highly skilled professional visa

- Best for: Retirees with exceptional skills or qualifications who wish to continue working

- Eligibility: Applicants must score at least 70 points on Japan’s points-based immigration system, which considers factors like education, income, and professional experience⁵

- Financial requirements: A minimum annual income of 8 million yen (about 69,700 SGD)

- Period of stay: Up to 5 years

Spouse or child of Japanese national

- Best for: Singaporeans who are legally married to or are children of Japanese nationals⁶

- Eligibility: Must be legally married to a Japanese national for at least three years and have lived in Japan for over one year, or be a biological or legally adopted child of a Japanese national and have resided in Japan for at least one year⁶

- Financial requirements: Income thresholds aren’t specified, but applicants should be able to support themselves financially⁷

- Period of stay: Up to 5 years⁸

Japan Permanent Residency

Since there aren’t a lot of visa options for retiring in Japan, permanent residency is the most stable long-term option. Typically, residency is granted to individuals who have lived in Japan for 10 years or more, with at least 5 consecutive years on a work or long-term resident visa.⁹

However, there are some exceptions for highly skilled professionals, who may be eligible after as little as 1–3 years, depending on their skill points and contributions to Japan.

How much do you need to retire in Japan?

How much you need to retire in Japan largely depends on where you live and your lifestyle, but on average, the cost of living is 57.7% lower than it is in Singapore.¹⁰ Here’s a look at the estimated monthly expenses you can expect in Japan vs what you may have been paying in Singapore.

| Japan | Singapore | |

|---|---|---|

| Rent - 1 bed apartment in city centre | 746 SGD | 3,971 SGD |

| Rent - 1 bed apartment outside of centre | 509 SGD | 2,937 SGD |

| Basic utilities | 218 SGD | 203 SGD |

| Transport - local ticket, one way | 1.92 SGD | 2 SGD |

| Meal in an inexpensive restaurant | 8.72 SGD | 12 SGD |

| Meal for two in a mid-range restaurant | 43.59 SGD | 100 SGD |

| Cinema ticket | 16.56 SGD | 15 SGD |

Housing costs

Rent and property purchase prices vary greatly depending on where you live in Japan, but compared to Singapore, housing tends to be more available and affordable, particularly in rural towns.

| Central Tokyo | Rural Japan | |

|---|---|---|

| Rent for a 1LDK (one bedroom with living/dining/kitchen) | 1,307 SGD/month | 523–697 SGD/month |

| Rent for single-family detached homes | 1,952 SGD/month | 627–802 SGD/month |

| Purchase | 1,046,160 SGD | 174,300 SGD |

If you’re looking for even cheaper housing, consider buying an akiya, a vacant or abandoned house in Japan.¹⁴ Japan’s population is shrinking and ageing, leaving many homes in rural towns empty. The government lists these properties in akiya banks, where they’re sold at low prices to encourage repopulation.

Healthcare expenses

Japan has a high-quality universal healthcare system that provides affordable medical care to all residents, including retirees. Long-term residents are required to enrol in either National Health Insurance or Employee Health Insurance, which typically covers 70% of medical costs.¹⁵

The other 30% you’ll have to pay out of pocket or invest in private insurance. Thankfully, healthcare is quite affordable in Japan. For example, a general consultation at a public hospital is between 43–87 SGD, but you’ll only pay 30% of this cost.¹⁶

Currency conversion costs

The SGD to JPY exchange rate is favourable, meaning your retirement fund will go further in Japan. But, when it comes to managing your SGD to JPY conversions, it’s important to note that traditional banks often offer a marked-up exchange rate and add hidden fees, making transfers more expensive. If you use Wise instead, you’ll get access to the real, mid-market rate with low, transparent fees, and you can even hold a JPY balance to convert and spend when rates are best.

Where to retire in Japan?

Where to retire in Japan depends on your personal preferences, as each city offers its own unique lifestyle, climate, and cost of living. Here is a quick look at four popular cities in Japan for retirees to help you make your decision.

Tokyo

Tokyo is an excellent choice for retirees who want a bustling urban environment with access to top-tier amenities and services. It offers a vibrant lifestyle for those who enjoy the energy of a major city.

Best for: Those who desire a fast-paced lifestyle with unparalleled convenience

Pros

- World-class infrastructure

- Vibrant culture and amenities

- Excellent healthcare

Cons

- High cost of living

- Crowded spaces

Kyoto

Kyoto is best for retirees who want a culturally immersive experience in a more tranquil setting. With its historic temples, beautiful gardens, and serene atmosphere, it is an ideal location for individuals seeking a peaceful lifestyle surrounded by tradition.

Best for: Individuals seeking a peaceful lifestyle surrounded by history and tradition

Pros

- Cultural heritage

- Safe and tranquil

- Efficient public transport

Cons

- Limited international amenities

- Crowded during peak seasons

Yokohama

Yokohama is an ideal option for retirees who are looking for a balance between urban amenities and a more relaxed lifestyle. Its modern infrastructure and proximity to Tokyo make it a perfect choice for those who want to enjoy city life at a slightly slower pace.

Best for: People who want to enjoy city life with a slightly slower pace and easy access to a major metropolis

Pros

- Proximity to Tokyo

- Modern infrastructure

- Blend of traditional Japanese culture and modern amenities

Cons

- Higher living costs

- Limited English

Osaka

Known as "the kitchen of the nation," Osaka is a vibrant and friendly city that offers a rich culinary scene and a more affordable cost of living compared to other major Japanese cities.

Best for: Food lovers and those seeking a lively urban atmosphere on a budget

Pros

- Affordable living

- Delicious food

- Friendly atmosphere

Cons

- High population density

- Language barrier

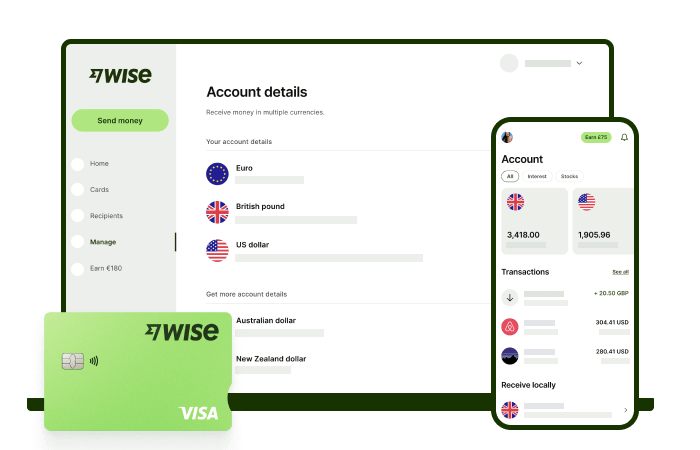

Wise - A smart way to manage your money across borders

The Wise account is an easy way to hold and exchange 40+ currencies, including SGD, MYR, EUR, CNY, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.26% and absolutely no markups. Plus, you can order a linked Wise card for convenient spending without any foreign transaction fees, and up to 2 free ATM withdrawals to the value of 350 SGD when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in SGD and a selection of other major global currencies.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

✍️ Sign up for a free account now

Sources

- Ministry of Foreign Affairs of Japan: Designated Activities Visa

- SME Japan: Business Investor Visa

- Golden Visas: Japan

- Ministry of Foreign Affairs of Japan: Working Visa

- Kyoto University International Service Office

- Samurai Immigration Law Firm: Spouse or Child of Japanese National Visa

- Continental Immigration & Consulting

- Ministry of Foreign Affairs: Spouse or Child of Japanese National

- June Advisors Group: Visa Support & Business Consulting in Japan

- Numbeo: Cost of Living in Singapore vs Japan

- Ehousing: Apartment rent by Prefecture

- Eaves Japan Magazine: Average Rent in Japan 2025

- Ehousing: How Much Is a House in Japan?

- Cheap Houses Japan

- InterNations: Health Insurance and Healthcare in Japan

- Alea: Healthcare Costs in Japan

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.