Third-Party Payment Providers: Guide for U.S. Businesses (2025)

Discover how third-party payment providers can streamline transactions for your growing US business

You’ve nailed your product, your storefront runs smoothly, and sales are climbing. But now you’re stuck—too much demand, not enough cash to meet it. You need e-commerce funding, and you need it now.

Unlike traditional businesses, e-commerce companies move fast. You need capital to restock inventory, launch marketing campaigns, upgrade tech, or expand to new markets—and you usually need it yesterday. But getting a traditional bank loan is slow, rigid, and rarely designed for how online businesses operate.

In this guide, we break down your best e-commerce financing choices, compare top e-commerce seller funding providers, and show you how to pick the right one to scale with confidence.

E-commerce financing refers to any form of capital, from debt-based, like loans, to equity-based, like investor backing, specifically structured to meet the needs of online sellers. E-commerce seller funding is designed with the realities of digital commerce in mind. That includes variable cash flow, seasonal revenue spikes, upfront inventory costs, rising ad spending, and platform transaction fees.

Because ecommerce businesses often grow rapidly and operate with tighter margins, conventional lending models don’t always fit. Banks typically require collateral, long credit histories, or slow approval processes—barriers that fast-moving online companies can’t afford.

Not all e-commerce business loans are created equal. The right funding structure depends on your revenue model, growth stage, cash flow predictability, and risk tolerance. Below is a breakdown of the most common e-commerce finance options, including their advantages, drawbacks, and when to use them.

Revenue-based financing is one of the most flexible ecommerce financing options. You receive capital upfront and repay a fixed percentage of your future sales until the total amount (plus a flat fee) is paid off.

Pros:

Cons:

Best For: Growth-stage ecommerce businesses with reliable revenue from platforms like Shopify1, Amazon2, or WooCommerce3.

Example Providers: Wayflyer, Choco Up, Clearco

MCAs offer a lump sum in exchange for a portion of your daily or weekly sales. This form of e-commerce seller funding is known for speed and simplicity.

Pros:

Cons:

Best For: Short-term cash flow emergencies or covering time-sensitive expenses like ad campaigns or supplier invoices.

Caution: Only recommended if your business has consistent daily sales volume and limited access to lower-cost capital.

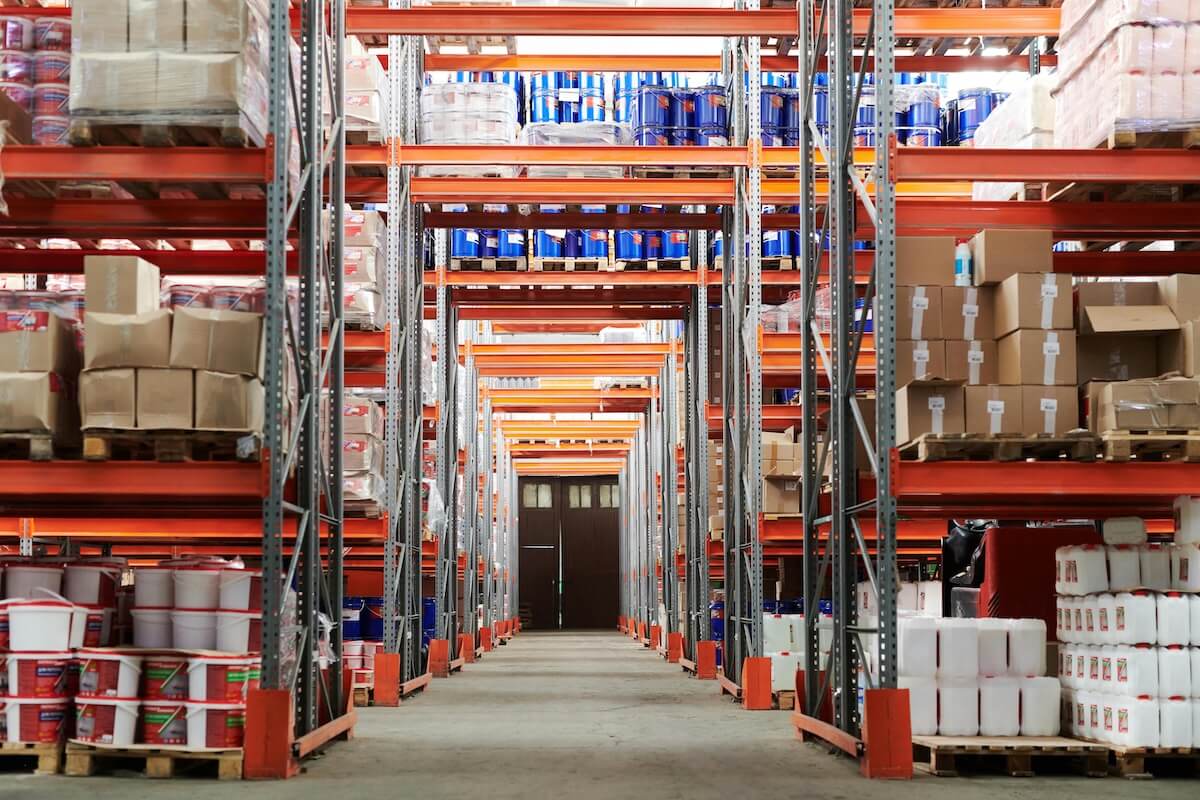

Inventory financing allows you to borrow against the value of your stock, freeing up working capital for marketing, operations, or R&D.

Pros:

Cons:

Best For: E-commerce businesses scaling Stock Keeping Unit (SKU)4 count or preparing for holiday surges, product launches, or wholesale orders.

Invoice factoring turns your unpaid invoices into immediate working capital. Instead of waiting 30–60 days on net terms, a third-party lender pays you a percentage upfront.

Pros:

Cons:

Best For: B2B ecommerce platforms or wholesalers working with large retailers on extended payment terms.

Traditional term loans offer fixed capital over a set repayment schedule, while lines of credit provide flexible drawdown and repayment options.

Pros:

Cons:

Best For: Established ecommerce businesses seeking funding for major projects, such as logistics infrastructure, tech upgrades, or international expansion.

Equity financing involves selling a stake in your company to investors in exchange for capital, while crowdfunding taps into your customer base or niche communities to pre-sell products or raise funds.

Pros:

Cons:

Best For: High-growth ecommerce startups aiming to scale aggressively or bring innovative products to market.

Each of these e-commerce financing models comes with trade-offs. The key is to align your funding source with your business goals, repayment capacity, and growth forecast.

Many fintech companies now offer e-commerce finance options specifically designed for online sellers. These platforms use real-time performance data to provide fast, flexible funding with fewer barriers than traditional lenders.

Each provider tailors its e-commerce seller funding to your business’s performance, not your credit score. That means faster approvals, more flexibility, and financing that matches the pace and rhythm of e-commerce growth.

With so many e-commerce finance options available, choosing the right one can feel overwhelming. The best solution depends on your current cash flow, growth stage, and long-term goals, not just the amount of funding you need.

Use the following criteria to evaluate your options and align them with your business strategy:

Start by being clear on why you need capital. Are you:

Your specific goal should shape your choice of e-commerce seller funding. For example, inventory financing is ideal if you need to place large product orders, while marketing-focused capital like Clearco’s is better suited for customer acquisition.

E-commerce revenue is rarely linear. If your business experiences fluctuations, like Q4 spikes or summer slowdowns, choose e-commerce financing that can adapt to these changes.

Revenue-based financing may be ideal for high-margin businesses with predictable seasonal sales. In contrast, fixed-payment term loans or lines of credit might work better for operations with steady but thinner margins.

Ask yourself:

The headline interest rate doesn’t tell the full story. Be sure to calculate the total cost of capital, including:

For example, a merchant cash advance might offer quick access, but the effective APR can be much higher than a traditional e-commerce business loan.

Even with strong sales, e-commerce is unpredictable. Ad platforms change, supply chains break, and returns spike. Make sure your funding model offers room to adjust.

This is where revenue-based e-commerce seller funding shines—your repayments scale with your earnings. On the other hand, a term loan might be riskier during uncertain periods but offers fixed costs that are easier to budget for.

If you're running a lean, fast-scaling ecommerce team, you may benefit from flexible working capital. If your operations are more complex, with warehousing, international sales, and payroll to manage, structured ecommerce business loans or a line of credit may offer more control.

In short:

The right funding option should provide you with both funding and stability. A great partner will boost your growth without adding risk, giving your team the confidence and runway to execute your plan.

Unlike traditional lending, e-commerce financing is built around speed, automation, and performance data. Most providers have streamlined their processes to eliminate unnecessary paperwork and focus on what matters: how well your business performs across key ecommerce metrics.

If your company operates on platforms like Shopify, Amazon, or BigCommerce, here’s what a typical application process looks like:

The first step is connecting your storefront directly to the lender’s portal. This gives the funding provider access to real-time data on your revenue, order volume, return rates, and customer behavior. The cleaner and more consistent this data is, the stronger your position.

While performance metrics are critical, lenders still want a 360° view of your business. You’ll typically be asked to upload:

This information helps underwriters verify that your margins can support the repayment structure, especially if you're applying for a larger ecommerce business loan or hybrid financing product.

Based on your data, the platform will generate one or more pre-approved offers. These aren’t generic loan terms—they’re structured to reflect your sales cycles, customer acquisition costs, and growth trajectory. Expect to see:

The key here is transparency. Unlike traditional loans, most e-commerce finance options come with straightforward pricing models and no hidden terms.

Once you accept an offer, digital contracts are signed, and funds are typically transferred within 24 to 48 hours. Some providers offer same-day funding, especially if you’re a repeat borrower with a strong performance history.

Here’s what you can do to improve your funding outcomes:

The ecommerce seller funding ecosystem favors transparency and performance. If your business is stable, data-driven, and ready to grow, you’ll not only get funded—you’ll get better terms, more flexibility, and a financing partner aligned with your long-term strategy.

As your ecommerce business grows, so do the stakes. Smart ecommerce financing should get you money, but it should also choose the capital structure that matches your business model. With dozens of ecommerce finance options available today, you can find funding solutions that scale with your revenue, protect your equity, and let you focus on what matters: selling better, faster, and more efficiently.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover how third-party payment providers can streamline transactions for your growing US business

A breakdown of how Square payment links work, how to pair with Square checkout, and how to customize, track, and integrate these tools into workflows.

We’ll walk you through what payment links are, how they work, who should use them, what benefits they bring, and how to choose the right provider.

Best ACH Payment Gateways For Businesses: 1. Stripe 2 Bill.com 3. PaySimple 4. GoCardless 5. Authorize.net ACH 6. Dwolla. Learn about their key features now!

Discover proven B2B SaaS pricing models for long-term success. Learn strategies for creating flexible and scalable pricing structures.

Understand the differences between payment gateways and processors and how to choose the right solution for your business.