How To Use WorldRemit To Receive Money In South Africa

Your guide on how to receive money from WorldRemit in South Africa, including collecting money as a cash pick up and documents you need to make an account.

With transparent fees and user-friendly mobile app that allows you to make international transactions to over 70 countries across Africa, Asia, and Europe,⁵ many South Africans are choosing Mama Money to send money abroad.

But what does the international transfer process with Mama Money look like? And what do you need to send money abroad with this provider? This article contains everything you need to know.

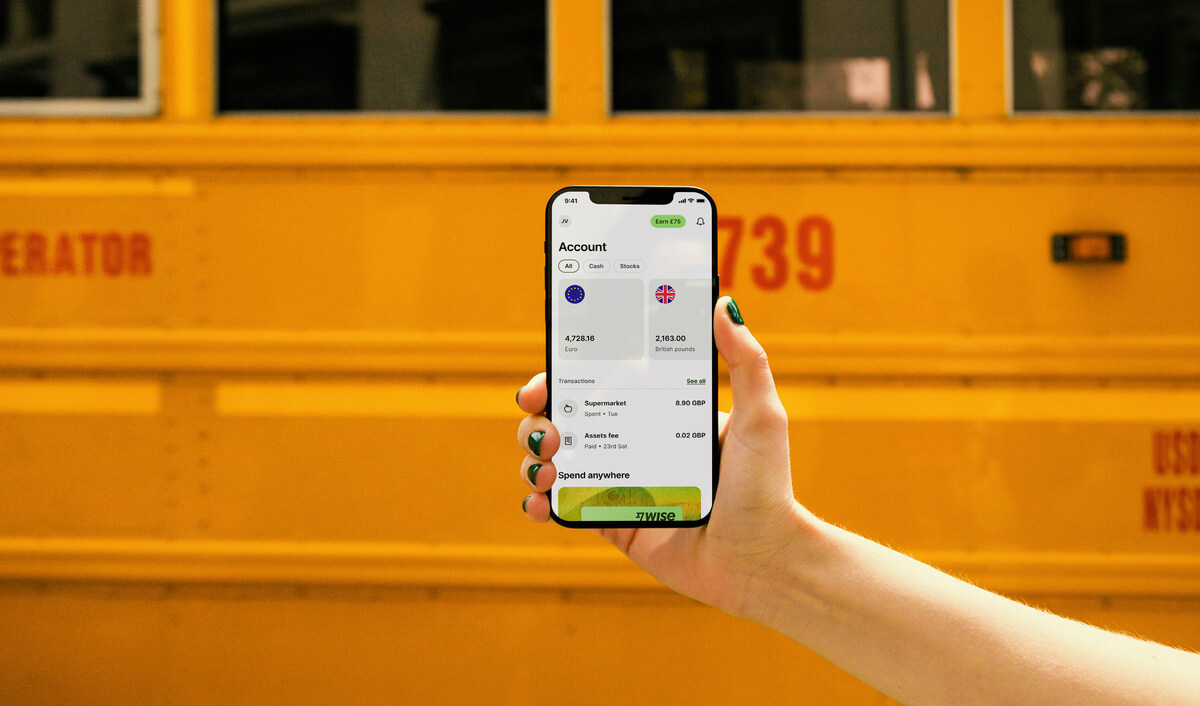

Also learn about Wise – that will show you how to make money transfers to South Africa at the mid-market exchange rate!

International transfer fees at Mama Money vary based on the country you’re making a payment to.⁶ There is a flat fee of 5% or less for international money transfers, and some fees can be as low as 1%.⁷ For example, if you want to send R5000 to Zimbabwe using Mama Money, you’ll pay an international transfer fee of R50, which is 1% of the total amount.⁸

You can use the Mama Money app to see the international transfer fee of the country you’re sending money to.⁹ This way, there are no hidden costs of making a payment abroad.

Exchange rates with Mama Money are dynamic and may vary according to the country you’re sending money to. Using the Mama Money app, you can check the Mama Money rate today for your country of choice.¹⁰ This way, you can see how much money your recipient will receive from the transfer, and the best time to send it.

At Wise, we use the mid-market exchange rate for international payments, which is considered the ‘fair market’ rate. Find out what you would pay for an international money transfer with Wise:

With Mama Money, you can send international payments from South Africa to over 70 countries across Africa, Asia, and Europe.⁵ These countries are listed in the table below.¹¹

| Continent | Country |

|---|---|

| Africa | Benin, Botswana, Burkina Faso, Burundi, Cameroon, Congo (ROC), Côte d'Ivoire, Democratic Republic of Congo, Egypt, Ethiopia, Ghana, Guinea-Bissau, Guinea, Kenya, Liberia, Madagascar, Malawi, Mali, Morocco, Mozambique, Nigeria, Niger, Rwanda, Senegal, Sierra Leone, Somalia, Tanzania, Togo, Uganda, Zambia and Zimbabwe. |

| Asia | Bangladesh, India, Nepal, Pakistan, Sri Lanka and United Arab Emirates. |

| Europe | Andorra, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxemburg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Spain, Sweden, Switzerland, The Vatican, Turkey and the United Kingdom. |

As well as sending payments internationally, you can receive payments into your Mama Money bank account from within South Africa.¹² With the Mama Money card, you can pay at any shop and withdraw money from an ATM, buy online from South African websites, and send cash to any PnP, Shoprite or Checkers in South Africa.¹³

If you’re a South African expat living abroad or someone wanting to send money to South Africa, Wise can help you save money¹ when making international money transfers back to South Africa.

Some banks and money transfer services use the mid-market rate when they trade between themselves, but they rarely pass it on to you. Instead, they often mark up the rate to make extra money.¹³

It is recommended to check the exchange rate offered by your bank against the mid-market rate, which is similar to the exchange rate shown on Google. Say no to hidden fees!

The mid-market exchange rate is the rate that banks use to transfer money between them and is considered the ‘fair rate’ in the market. Find out what you would pay for an international money transfer with Wise:

Wise customers don’t have to pay an additional markup fee but only a small transparent fee to make an international transaction¹. That’s because Wise uses the mid-market rate for overseas payments!

With Wise, South African expats can save money¹ on an international money transfer by providing low fees and also do away with the markup on the mid-market exchange rate when making international payments to South Africa.

Knowing how long it takes for a payment to arrive in your recipient’s account is an important factor to consider when making an international transaction. Below is a table detailing how long it takes for Mama Money to send your payment to another country.¹⁴

| Type of transfer | Time transfer takes |

|---|---|

| Mobile wallets | Within minutes |

| Cash collection | Within minutes |

| Bank accounts | Transfers take roughly 5 hours but can take up to 48 hours depending on the bank of the recipient |

If you need help with making an international transfer or have another question about your Mama Money bank account, you can reach out to the customer support team easily either through the Mama Money app,¹⁵ or directly using the details below.¹⁶ Make sure to have your account details and relevant transaction information with you.

Resolve your issue in real time by contacting Mama Money support using WhatsApp.

Mama Customer Care: (+27) 66 802 8428

Mama Money Send: (+27) 60 091 5591

USSD: *134*542#

Phone

Get help with your issue straight away by phoning the Mama Money contact number: 0212025420

Social Media

Chat with the Mama Money customer support team through Facebook, Instagram, Twitter, or LinkedIn.

Send your question to mama@mamamoney.co.za for help within 24-48 hours.

In-Person

Speak to one of Mama Money’s nationwide agents and get face-to-face assistance.

International transfers with Mama Money are done through the Mama Money app, which can be downloaded for free from the Google Play or Apple App Store.

Once you have downloaded the app, you can complete the Mama Money registration using the instructions below:¹⁷

To make an international transfer with Mama Money, you will need to provide the following information about your recipient:¹⁸

With a standard Mama Money bank account, you can make an international transfer of up to R5,000 per transaction and R25,000 per month..¹⁹

If you want to send more money abroad, you can upgrade your account. With an upgraded Mama Money bank account, you can send up to R50,000 per transaction and R100,000 per month abroad.

To upgrade your account, go to the “More Money Home” option in the app. New customers can also choose to upgrade when they first register.²⁰

Many South Africans choose Mama Money to make payments abroad, thanks to its user-friendly app, transparent transfer process and long list of countries where you can send money.

Wise uses the mid-market exchange rate for international payments. Since this is the rate banks use to transfer money between them, it’s considered the ‘fair rate’ for sending money abroad. If you’re looking for a fair and transparent payment provider for international transactions, Wise is a great alternative.

Sources

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Your guide on how to receive money from WorldRemit in South Africa, including collecting money as a cash pick up and documents you need to make an account.

Everything you need to know about how to receive money from Western Union in South Africa, including how and where to pick up cash, and the documents you need.

Discover how to send money abroad from South Africa using Payoneer, including the transfer fees, exchange rate and what you need to make a payment.

The easy guide on how to receive money from PayPal in South Africa, including international PayPal fees and how to link your South African bank account.

Need to transfer money from Capitec to FNB but unsure on how to? Our guide has you covered!

Need to transfer money from Capitec to Standard Bank but unsure on how to? Our guide has you covered!