Microsoft 365 and Copilot pricing and plan guide UK 2025

Explore the latest Microsoft pricing in the UK for 2025. Find out which plans and add-ons suit your business and how to save on your subscription costs.

Looking for a payroll software to help your startup manage employee payments, save time and stay compliant?

In this guide, we will review six of the best payroll software for startups in the UK, including Gusto, Wave, Deel, Plane, QuickBooks Payroll, and Ripping. We will compare their features, fees, and integrations, and share tips to help you choose the best payroll software.

And while you are exploring payroll services for startups, consider solutions like Wise Business. With Wise business, you can send payments to employees and contractors in 140+ countries while saving money on fees.

💡 Learn more about Wise Business

Payroll software helps startups simplify payments, automate tax filings, and stay compliant with local laws. Many tools also offer extra features like onboarding, offboarding, and even employer of record services for global teams.

In this guide, we will review the best payroll software for startups, including:

| Provider | Trustpilot score | Monthly fee | Best known for |

|---|---|---|---|

| Gusto | 2.2¹ (from +2000 reviews) | starting from $49² | Comprehensive payroll and benefits management for startups |

| Wave | 1.2 from 150 reviews³ | starting from $40⁴ | Free basic accounting features and affordable payroll services |

| Deel | 4.8 from +7k reviews⁵ | Starting from $29 per employee⁶ | Hiring, management and payment of global teams |

| Plane | 3.2 from 5 reviews (unclaimed profile)⁷ | Starting from $19⁸ per US employee | Fast payment processing |

| Quickbooks payroll | N/A | Starting from $85⁹ | Seamless integration with Quickbooks accounting software |

| Rippling | 4.5 from +1.3k reviews¹⁰ | Custom quote¹¹ | Clean UI, comprehensive HR solutions and flexibility |

We will compare six providers that offer payroll outsourcing for global startups, using the following criteria:

Gusto is a leading payroll solutions provider for startups. Gusto is known for being affordable, user-friendly, and comprehensive. It handles everything from recruiting and onboarding to payroll, tax filings, and benefits management. It is essentially an all-in-one online HR assistant.

Gusto has a Trustpilot score of 2.2 from +2.2k reviews.¹ Here’s what a customer has to say:

“Gusto has been so user-friendly. I will be happy to recommend gusto to any employer looking for a payroll company” — Courtenay Summers¹

| Plan | Monthly base fee² | Per person fee² |

|---|---|---|

| Simple | $49 | $6 |

| Plus | $80 | $12 |

| Premium | $180 | $22 |

| Contractor only | $0 | $6 |

Some of Gusto’s integrations include:

💡 Learn more about Wise Business

Wave is a payroll and accounting software that helps small businesses manage finances. It is well known for its free accounting features and affordable payroll services. Wave currently has a Trustpilot score of 1.2 from 150 reviews.³

Wave charges a $40 per month base fee and an additional $6 per active employee and $6 per independent contractor paid for its payroll services.⁴

You can also opt in for Wave’s regular plans with payroll as an add-on service.

| Fee type | Cost⁴ |

|---|---|

| Monthly subscription | $0 |

| Option to accept online payments | Starting at 2.9% + $0.60 |

| Digitally capture unlimited receipts (add-on) | $8 a month or $72 a year |

| Run payroll (add-on) | From $40 a month |

| Hire a bookkeeper (add-on) | From $149 a month |

| Fee type | Cost⁴ |

|---|---|

| Monthly subscription | $16 |

| Option to accept online payments (credit card transaction) | 2.9% + $0 |

| Run payroll | From $40 a month |

| Hire a bookkeeper | From $149 a month |

Wave integrates with several apps on Zapier including:

Deel’s payroll services for startups helps businesses save time and money on administration while staying compliant with regulations. Deel is known for its fast payments, easy-to-use user-friendly interface, and responsive customer service. It has a 4.8 score on Trustpilot from +7k reviews.⁵ Here’s what a Deel customer has to say:

“Excellent payroll service. I have been using it to receive payment for years without an issue” – Ahmed Abouzekry⁵

| Fee Type | Monthly ost⁶ |

|---|---|

| Deel EOR (Employer of Record) | $599 per employee |

| Deel Contractor Management | $29 per contractor |

| Deel Contractor of Record | $325 per contractor |

| Deel PEO | $95 per employee |

| Deel global payroll | $29 per employee |

Some of Deel’s integrations include:

Plane is a global payroll and HR management software designed to help small businesses manage their teams from a single dashboard. It is known for its fast international payment processing and wide global coverage. Plane has an unclaimed Trustpilot profile with a score of 3.2 from 5 reviews.⁷

| Fee Type | Monthly cost⁸ |

|---|---|

| HRIS platform | $0 |

| Contractors | $39 per employee |

| Employees - US | $19 per employee |

| Employees - EOR | $499 per employee |

QuickBooks Payroll is a payroll management software developed by Intuit QuickBooks and is known for its seamless integration with the QuickBooks accounting software package. QuickBooks Payroll is a go-to choice for small businesses that want to manage payroll and finances in one place.

Quickbooks offers payroll features as an add-on to each of its tiered plans.

| Fee type | Monthly cost¹⁰ |

|---|---|

| Simple start | £16 |

| Essentials | £33 |

| Plus | £47 |

| Advanced | Custom |

You can also access payroll features directly through the payroll plans.

| Fee type | Monthly cost¹¹ |

|---|---|

| Payroll core + simple start | $85 + $6 per employee |

| Payroll core + essentials | $115 + $6 per employee |

| Payroll premium + plus | $184 + $9 per employee |

Here are some of QuickBooks Payroll integrations:

Check out our comprehensive Quickbooks Payroll guide for more information about QuickBools Payroll fees and features.

Rippling is a comprehensive workforce management platform for streamlining HR, IT, and Finance operations. Rippling is well known for its ease of use and versatility. The payroll software has a Trustpilot score of 4.5 from +1.3k reviews.¹⁰ Here’s what a Rippling user has to say:

“I use rippling on a daily basis…to communicate with my managers and to receive my pay working for an international company. Rippling makes it so much easier for me” – Karen Carmo¹⁰

Rippling bills most of its services on a per-month or per-person basis, although some plans may include a monthly base fee. You will need to contact Rippling to get a custom quote.¹¹

Rippling integrates with 500+ apps including:¹⁴

Payroll for startups should be flexible, scalable, and cost-effective. A good payroll software will help you stay on track with employee payments and avoid costly tax mistakes. Here’s what to look out for in a payroll software:

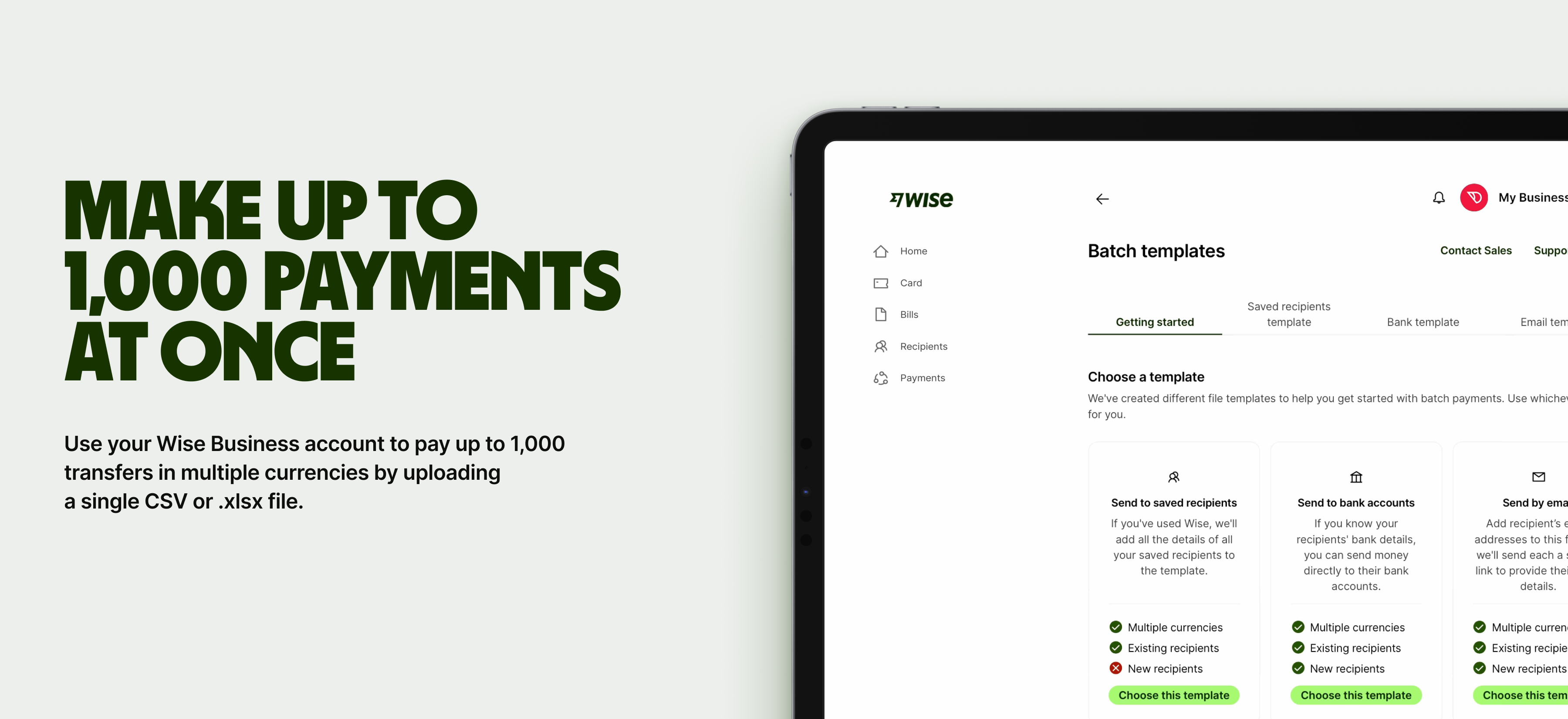

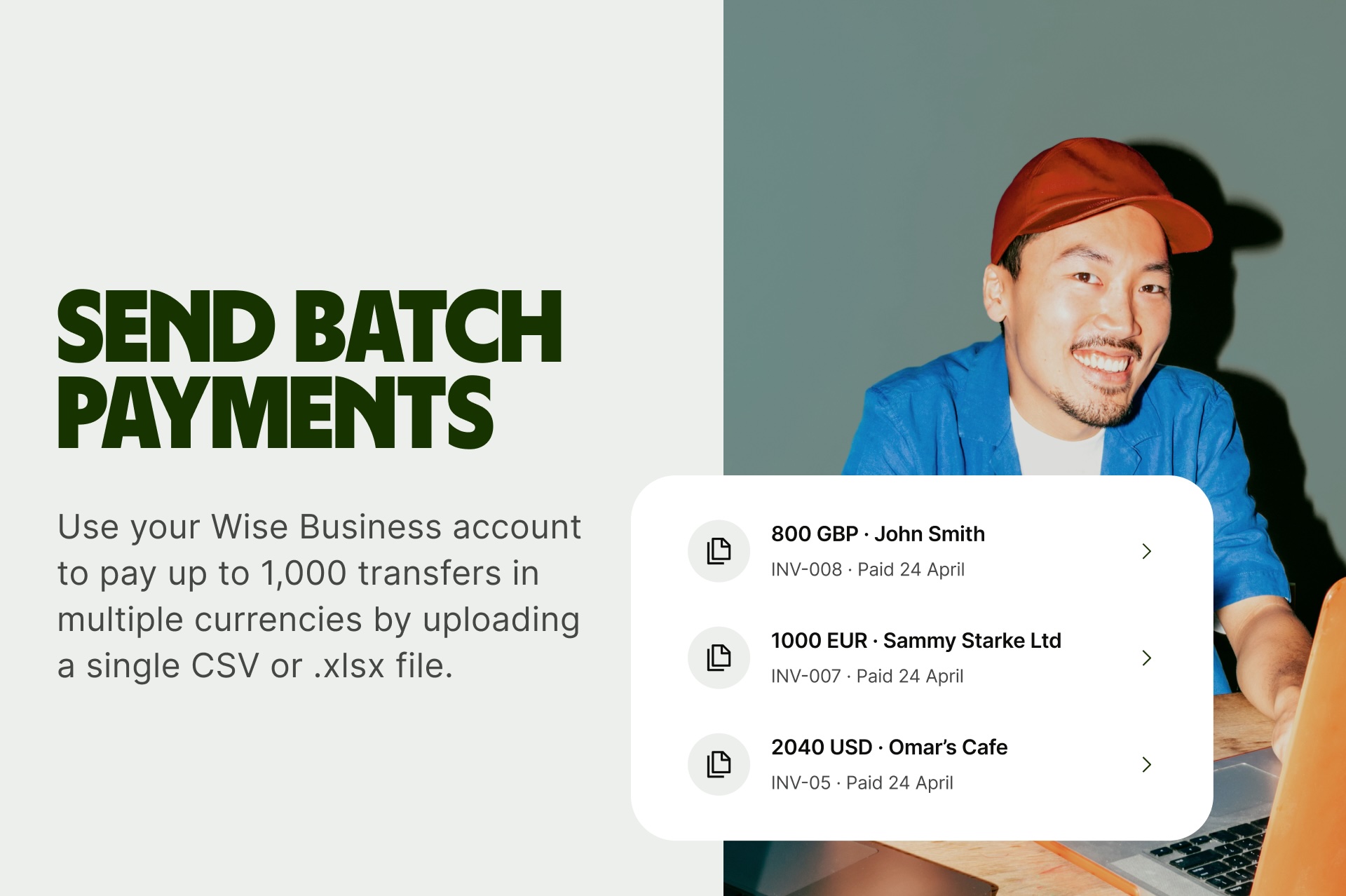

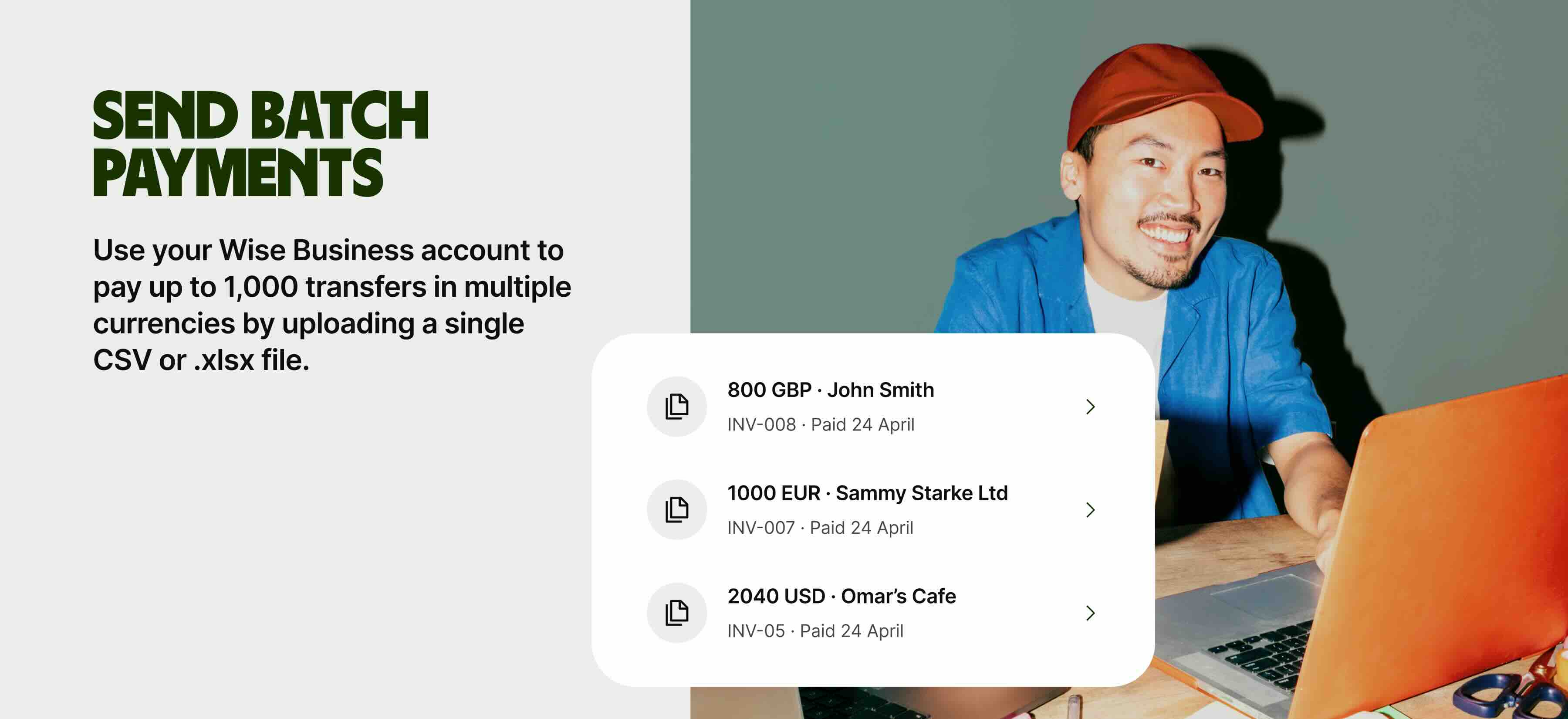

Open a Wise Business account and you’ll be able to pay international employees and contractors in their own currency. You can send 40+ currencies in just a few clicks using the Batch Payments tool or even automate the process entirely using the Wise API.

Wise payments are fast¹⁹ and secure (even for large amounts). Best of all, you’ll only pay low, transparent fees and always get the mid-market exchange rate.

Get started with Wise Business 🚀

The best payroll services for startups depend on your startup’s needs. QuickBooks payroll offers great accounting integration, Plane or Deel is great for international compliance if you are hiring globally.

Payroll software costs depend on the features you want. Some payroll platforms, like Wave, offer some basic features for free, while others offer tiered pricing. For payroll software like Rippling, you’ll need to reach out for a custom quote.

Yes. Payroll outsourcing helps you manage multi-currency payments, reduce the legal risks of global hiring and ensure local tax compliance.

Choosing the right payroll software for your startup can help you save time on manual tasks, save costs, and avoid harsh penalties by staying compliant. Look for features like budget friendliness, ease of use, integrations, and customer support to help you make the right decision. Additionally, you can consider trying out a free trial or a demo before making a full commitment.

Sources used in this article:

Sources last checked 29/06/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore the latest Microsoft pricing in the UK for 2025. Find out which plans and add-ons suit your business and how to save on your subscription costs.

Check out our helpful guide to transferring large amounts with Revolut Business, including transfer times, limits and how to set up your first payment.

Discover the best AI tools to automate your business in 2025. From marketing to HR, streamline workflows, save time, and boost productivity.

Streamline invoice processing and boost cash flow with AP automation. Learn how it works and the tools to help your business grow.

Discover the process related to cross border payments, steps, fees involved and providers that enable international payments, including Wise Business.

Discover the best accounts payable automation software providers for business in the UK. Check features, reviews and pricing.