Airwallex NZ: Guide to business accounts, fees & global payments

Learn more about Airwallex in New Zealand. Our guide covers its all-in-one business accounts, products and features offered, and fees.

Whether you’re a sole trader or CEO, a business credit card can help you better manage expenses and cash flow. Designed with businesses in mind, these convenient products entice customers with alluring rewards or low interest rates and fees.

A bounty of business cards is available in New Zealand, each appealing to different needs. We’ve compiled a comprehensive business credit card comparison guide to help understand the options that would best suit your need.

| Table of contents |

|---|

Business credit cards entail many benefits.

The downside? A sky-high interest rate applies once the interest-free period expires. Fail to pay your card off in full by the due date, and you’ll get slugged with a hefty, perpetually accumulating fee–AKA, a debt trap.

Strict fiscal discipline is vital. Instant access to vast swathes of cash makes overspending tempting, especially for ambitious, growth-mindset entrepreneurs. If you’re unsure about your monthly repayment capacity, a business debit card might be a better fit.

Sign up for the Wise Business account! 🚀

There are a plethora of things to consider when weighing up the options.

To apply for a business credit card, you must be:

You must also meet credit card-specific lending criteria, like business registration documentation, credit ratings, and income/cash flow. If approved, the card issuer will assess your situation and offer an appropriate line of credit.

The interest-free period is the time you have to pay your balance without incurring interest. Typical interest-free periods range from 44–55 days. However, billing cycles often run monthly, meaning you may have to pay by the last day of the following month, regardless. Read the fine print; you don’t want to miss this deadline.

Longer interest-free periods may help businesses better manage cash flow.

Interest rates apply after the interest-free period expires if you haven’t paid off your balance in full. This rate is a percentage of the amount owing, typically in the range of 13% to 25% per annum (p.a.) for overdue credit card payments. That’s significantly higher than other loan types.

A business credit card with a lower interest rate lets you borrow money for less. Some companies find this loan useful to make strategic business investments.

Some business credit cards offer rewards instead of low interest rates to attract big-spending clientele. Common examples include:

Almost all business credit cards have annual fees, typically ranging from $50 to $150. Some charge in six-month instalments, and others charge fees for each additional card.

One business credit card won’t necessarily have a higher limit than another. The provider typically sets a credit limit based on your financial situation and existing relationship.

Failed to pay your balance on time? Some business credit cards charge heftier late payment fees than others. Forgetful types should keep this in mind.

Over-limit fees apply when you spend more than your monthly line of credit. This fee varies by card and is typically a percentage of the over-limit expenditure.

Cash withdrawal interest rates are often higher than purchase interest rates. It’s a crucial consideration if you plan to withdraw cash and may fail to pay it off by the end of the month.

Foreign transaction fees apply when purchasing from overseas vendors. Credit cards use their own exchange rates, which may have built-in markups.

Alternatives, such as the Wise Business Debit Card, offer a low international transfer fee and use the mid-market exchange rate for currency conversions to save you money when dealing with global payroll, suppliers, and other transactions.

Sign up for the Wise Business account! 🚀

Here are some top Kiwi business credit cards for companies with varying needs.

Businesses with cash flow management woes might find the ANZ Visa Business Low Rate Card1 a good fit. With a generous 55-day interest-free period, this option appeals to companies looking for longer repayment terms. A modest annual account fee sweetens the deal.

A relatively low interest rate of 13.90% on purchases softens the sting should you fail to pay in full at the end of the month. ANZ also offers business credit cards with rewards, but they come with a higher interest rate.

| Fees |

|

| Rewards or Points | None |

| Interest-free period | Up to 55 days on purchases |

| P.A. interest rate |

|

| Number of cards per account | Up to 15 |

| Security | Complimentary Liability Waiver insurance |

A low-interest alternative is the BNZ Business First Lite Visa2, which has a slightly higher interest rate of 14.95% p.a. on purchases. However, it uses the same rate on cash advances, which is much lower than the aforementioned ANZ option.

Therefore, this card may appeal to businesses needing to borrow cash at a lower interest rate with a 55-day interest-free repayment term. Customers can access up to $50,000 when applying through the BNZ QuickBiz loan service.

| Fees |

|

| Rewards or Points | None |

| Interest-free period | Up to 55 days on purchases and cash advances |

| P.A. interest rate | 14.95% p.a. for purchases **and **cash advances |

| Number of cards per account | Unlimited (per-card fee applies) |

| Security | Users can set daily transaction and withdrawal limits |

| Line of credit | Up to $50,000 |

As the name suggests, the Westpac Airpoints Business Mastercard is designed for frequent flyers.

In exchange for a higher account fee and interest rate, you earn Airpoints Dollars to spend on Air New Zealand flights, upgrades, and other travel-related goodies. Status Points can upgrade your membership tier with Air New Zealand and partner airlines, while the Koru program provides lounge access.

Business travellers who spend too much time in planes and airports might get good value out of this one.

| Fees |

|

| Rewards or Points |

|

| Interest-free period | Up to 44 days |

| P.A. interest rate |

|

| Number of cards per account | Up to 5 additional cards |

| Security | Up to 90-day purchase protection and extended warranty on purchases3 |

If you’re more keen on rewards than travel perks, you may prefer the ASB Visa Business Rewards. Customers can redeem True Rewards4 at participating retailers, such as Mitre 10. Everyday Rewards work with Woolworths and BP, perfect for fueling up or doing a grocery run.

| Fees |

|

| Rewards or Points |

|

| Interest-free period | Up to 50 days on purchases |

| P.A. interest rate |

|

| Cards per account | Up to 4 cardholders per account |

| Security features |

|

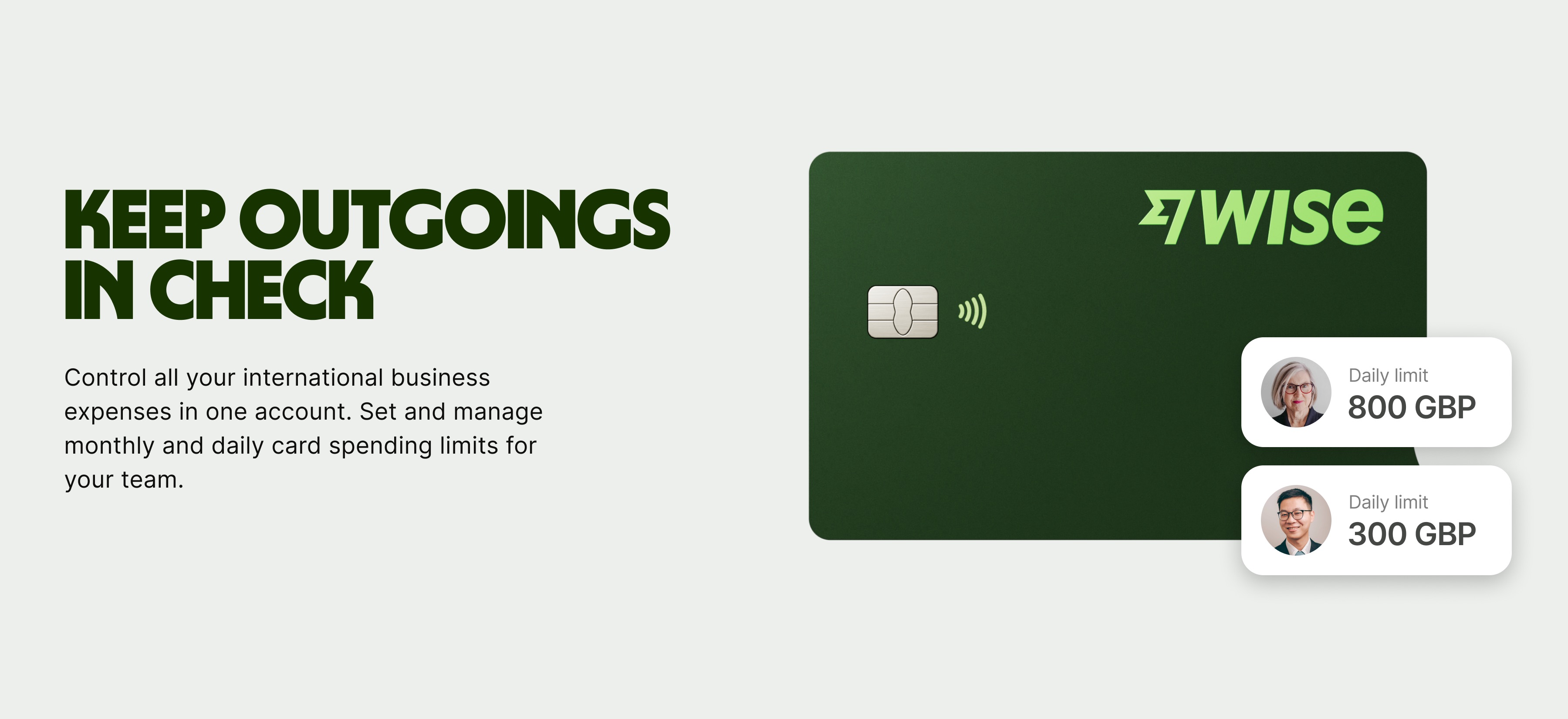

A credit card isn’t the only way to separate personal and business expenses. Kiwi companies sending money overseas may benefit from the Wise Business Debit Card. While you won’t receive a line of credit, you could save money through low-cost international transfers using the mid-market exchange rate.

Simplify how your team manages international expenses. Wise Business debit cards offer a straightforward and efficient solution for spending and withdrawing funds across the globe.

Want a simpler way to handle your team's international expenses?

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

What’s the difference between a business and a personal credit card?

Business credit cards typically have higher limits and business-oriented rewards. Customers may need to provide business registration details to apply.

What are the risks of a business credit card?

Failing to repay your monthly balance can result in a hefty interest rate and may negatively impact your credit rating.

Is a business debit card better than a business credit card?

It depends on your situation. A business debit card may be beneficial if you aren’t 100% sure you can meet your monthly repayments.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about Airwallex in New Zealand. Our guide covers its all-in-one business accounts, products and features offered, and fees.

Comparison of Airwallex vs Wise for NZ businesses. Overview of difference fees, features, and usability to find the best fit for your business. Read here!

Learn how to start a business in New Zealand. Our guide details business structures, registration steps, tax & GST rules, costs, and how to overcome challenges.

Learn what documentation you need to open a business account online, the steps you must follow, and which New Zealand banks offer online setups.

Learn what to consider when weighing up different payroll options. Compare some of the top payroll solutions for small businesses in New Zealand.

Looking for the right business banking in NZ? We compare products, fees, and services from top banks in New Zealand to help you choose the best fit.