Airwallex NZ: Guide to business accounts, fees & global payments

Learn more about Airwallex in New Zealand. Our guide covers its all-in-one business accounts, products and features offered, and fees.

Registering a company in New Zealand requires a myriad of forms, declarations, registrations, verifications, and account creations.

But it could be worth the hassle for an ambitious Kiwi entrepreneur. A company is scalable, credible to investors, has various tax benefits, and creates a separate legal entity to limit liability.

Besides, the process isn’t that daunting with a little know-how on registering a company in New Zealand.

| Table of contents |

|---|

Before tackling this epic red-tape saga, is a company really ideal? Kiwis trading solo or with a companion might prefer a sole trader or partnership structure instead. Consult an accountant and also take some time to review the 'Choose a Business Structure Tool'.

New Zealand has three different company types.

The Limited Liability Company: The most common type, recognisable by the "Limited," "Ltd," or "Tapui (Limited)" tag, sees the company take liability for legal and financial obligations. Shareholders are only liable for money owing on shares and personal guarantees.

The Co-operative Company: Also known as a co-op, this type of limited liability company provides goods and services to its members to serve their common needs.

Unlimited Company: This rare company type doesn’t limit shareholder liability. Thus, it's usually only used to meet specific international legal requirements.1

You must register a company through the aptly-named New Zealand Companies Office.

If you haven’t got one, you’ll first need a RealMe® login account. This secure platform verifies your identity so you can access various government services using a single username and password.2

Use the login to create an online services account with the Companies Register. Select “I am using this website as an individual” if you’re the company director and want exclusive access. Follow the steps to create your online services account.3

Brainstorm names that are relevant, memorable, and reflect your brand. Get feedback from colleagues.

The Companies Act 1993 prohibits registering a name that is identical or almost identical to an existing company.4

Use the Business NZ ONECheck Tool to see if your name is taken, what relevant webpage domains are available, and if any similar trademarks exist.

To reserve your company:

Upon registering its name, you’ll have 20 working days to incorporate your company.5

Gather documentation regarding your contact details, taxes, directors, shareholders, ultimate holding company, and constitution. We’ll provide the details later in this post.

You received an email when reserving your company name, which had a link to begin the online application process. Alternatively, log in to your online services account. Select “My unfinished business,” “My tasks,” and “Complete Coy Application.”

Follow the prompts to upload your documents and pay the $118.74 (plus GST) application fee.6

You’ll receive an email with consent forms for each shareholder and director. You can also find these in your online services account under “My unfinished business.”

The Companies Register will pre-fill most of the form. Each shareholder and director must review the information and sign their own form.

To submit signed forms, go to the “My Unfinished Business” tab on your online services account. Select your company from “My Tasks,” and upload each form as a single-page PDF file under 20MB.

The Companies Office usually approves consent forms within one hour during normal office hours. Rejections will be notified by email along with a reason.7

Upon approving the consent forms, the Companies Office will send you a Certificate of Incorporation with your unique company number. Your company will appear on the public Companies Register.

The Companies Office will tell you which month your annual returns are due. You may change this month to better suit your business under certain conditions.8

Registered companies automatically receive an NZBN and are added to the NZBN register, a public record of your business name, status, address, and contact details.9

You must gather the following documentation.

Requirements may depend on your circumstances.

New Zealand companies must have one director living in New Zealand, or living in Australia while directing an Australian company. This person can’t be under 18, bankrupt, or prohibited from fulfilling the position under statutory provisions.12

You can register a director in your online services account through the “Directors” tab by providing a:

You will receive the director's consent form(s) via email that you must submit within 20 working days.13

You must register all shareholders at the time of incorporation and disclose what shares they own. Depending on the shareholder–individual, company, or trustee–you will need to provide details like names, addresses, and IRNs.

You will receive shareholder consent forms via email that you must submit within 20 working days.14

If a UHC controls your company, you must provide information on its name, type, registration number, country of origin, and registered address. You must advise the Companies Office of any change of status within 20 working days.15

A company constitution details the rights, duties, and powers of the company board, directors, and shareholders.

It’s not legally required when incorporating a limited company. If you decide to incorporate without a constitution, the Companies Act 1993 will govern your company.

You can purchase a pre-made constitution or create your own to submit with your application.16

While this is not mandatory for all businesses, it is best practice to have access to a dedicated business account to separate personal and company expenses for streamline record-keeping.

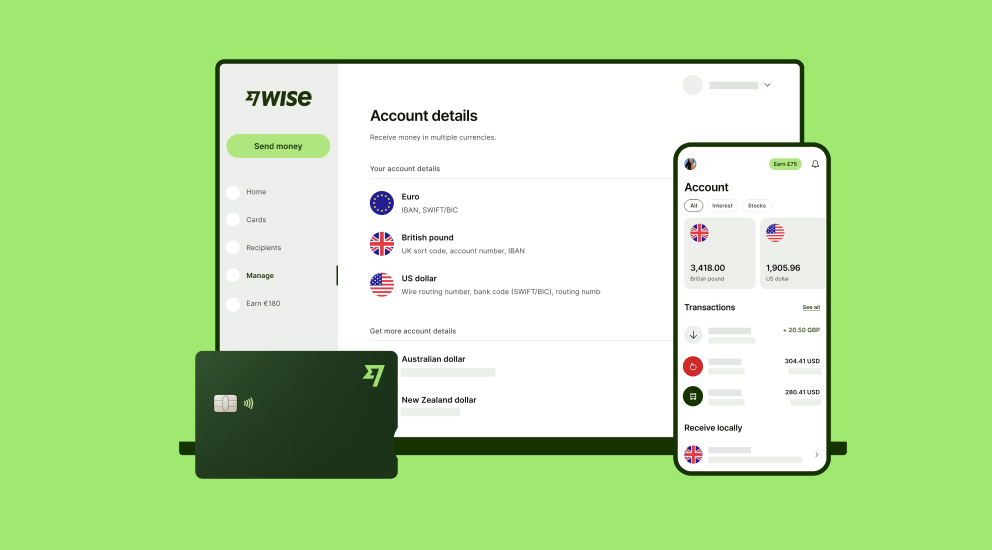

For Kiwi companies sending money across borders, Wise Business offers an affordable alternative to the banks. The transparent pricing means no hidden markups, and users get the mid-market exchange rate on every transaction.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

Some of the basic costs involved are: NZ$105 (plus GST) to reserve a company name and NZ$118.746 (plus GST) to incorporate a company.

The online application only takes around 30 minutes. But collecting the paperwork can take days or even weeks. You’ll have 20 working days from the date you reserve your company name to complete the process.

Setting up a business in New Zealand as a foreign national requires obtaining an Entrepreneur Work Visa, which has stringent requirements.

Sources

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about Airwallex in New Zealand. Our guide covers its all-in-one business accounts, products and features offered, and fees.

Comparison of Airwallex vs Wise for NZ businesses. Overview of difference fees, features, and usability to find the best fit for your business. Read here!

Learn how to start a business in New Zealand. Our guide details business structures, registration steps, tax & GST rules, costs, and how to overcome challenges.

Learn what documentation you need to open a business account online, the steps you must follow, and which New Zealand banks offer online setups.

Learn what to consider when weighing up different payroll options. Compare some of the top payroll solutions for small businesses in New Zealand.

Looking for the right business banking in NZ? We compare products, fees, and services from top banks in New Zealand to help you choose the best fit.