GCash Cash In Fees: A guide to fees, limits and free methods in 2025

A transparent guide to GCash cash-in fees. Get a full breakdown of charges at different partners and learn the best methods to cash in for free.

If you hold an account with BPI¹ and need to move money to a GoTyme² account instead, you’ll need to either link your BPI and GoTyme accounts, or set up a transfer from BPI to be received into GoTyme.

This guide walks through how to transfer money from BPI to GoTyme including the limits, fees and delivery time to know about. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

Yes. You can transfer money from BPI to GoTyme in two different ways. You can either choose to link BPI and GoTyme, which allows you to initiate the payment from the GoTyme app, or you can log into your BPI digital banking service to start the payment from that side instead⁴. In either case the transfer of funds from B³PI to GoTyme happens through the InstaPay network, for almost instant credit in PHP.

There is a BPI to GoTyme transfer fee which can be imposed by both BPI and GoTyme, depending on how you use your account. We’ll look at this and the BPI transfer limits in just a moment.

When you send money from BPI to GoTyme it's processed through InstaPay for real time deposit⁵. This means it’s pretty much instant, and your money should be available for you in GoTyme right away, with service availability 24/7.

BPI has a 10 PHP fee for InstaPay transfers to GoTyme. This fee is waived for BPI Preferred, BPI Gold, and BPI Private Banking clients.

On top of this you may also pay a GoTyme fee. GoTyme allows you to have 2 Fund In by Linked Account (FILA) transfers for free every month, and then charges you a 1% fee for your BPI transfers after that. GoTyme fees for different banks can vary.

The BPI to GoTyme transfer limit may depend on your status as a BPI customer. Here’s a summary:

- BPI per transfer limit: 50,000 PHP

- BPI daily transfer limit: 250,000 PHP, or 500,000 PHP for BPI Preferred, BPI Gold, and BPI Private Banking clients

There’s no limit on the number of daily transfers you can make from a BPI account as long as the cumulative amount remains under the cap which applies to your specific account type. If a BPI to GoTyme transfer failed for you, it may be because you have exceeded a limit, or your account was not correctly set up.

As we’ve seen, you can either initiate the transfer from BPI to GoTyme in the BPI app, or from GoTyme directly if you’ve linked your accounts together.

Here’s how to transfer money from BPI to GoTyme from the BPI website or app:

Once the transfer is complete, your money will be deposited into your GoTyme account in real time.

As an alternative, you can link BPI and GoTyme which allows you to move your money to GoTyme from the GoTyme app. You might prefer this if you manage your money day to day with GoTyme as it will mean you don’t need to log into BPI to initiate the transfer.

Here’s how to link BPI to GoTyme in case this is the option you prefer:

Once you have linked your BPI and GoTyme accounts you will not need to repeat this process to make future transfers. You can repeat the same transfer, or select BPI as the account to fund your GoTyme account from, and then top up a different amount if you prefer.

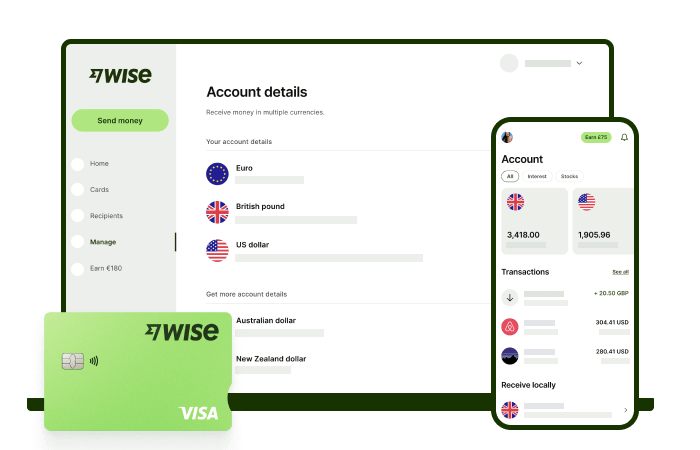

Send foreign currency, receive money from abroad and exchange it directly to pesos at the mid-market rate with Wise.

Ang pagpapadala ng pera abroad sa Wise ay madaling i-set up online o sa Wise app, with low fees na nagsisimula sa 0.57%. Gamit din ang mid-market rate, papunta sa mahigit 140+ na bansa. Walang patong idinagdag sa exchange rate na ginagamit para i-convert ang pera mo, kaya mas madali mong makikita kung magkano talaga ang binabayaran mo kada transfer, at kung ano ang matatanggap ng recipient.

Para mas madali ang pagpapadala, gumawa lang ng libreng Wise account. Mae-enjoy mo nang i-manage at i-convert and pera mo sa PHP at sa 40+ pang currencies. Makukuha mo rin ang sulit na exchange rate at masusubaybayan mo din ang transfers sa account mo. Pwede ka ring makakuha ng 8+ local account details para makatanggap ng pera sa PHP, USD, GBP, at marami pang iba.

It’s simple and stress free - and you can stay on top of your finances no matter what you’re up to.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A transparent guide to GCash cash-in fees. Get a full breakdown of charges at different partners and learn the best methods to cash in for free.

Want to cash out from Lazada Wallet to GCash? Learn more about how to transfer, convert, and refund credits.

Want to transfer money from Maya to SeaBank? Learn more about how to send money across platforms.

Want to transfer money from BDO to Maya? Learn more about how to send money across platforms.

Want to transfer money from SeaBank to PayPal? Learn more about how to send money across platforms.

Want to cash inGCash to Shopee Pay? Learn more about how to send money across platforms.