CIMB Visa Infinite Review Singapore (2025): The Best No-Fee Travel Card?

Looking for the best CIMB travel card in Singapore? We review the top cards for airport lounge access, travel insurance, cashback and more.

Digital brokerages and platforms like IBKR¹ are growing in popularity among Singaporean investors, as they make it easy to trade and invest with nothing more than your phone. Download an app, sign up for an account, and you could add money to trade and invest in just a few taps, with access to an extremely broad range of assets to suit different customer needs and risk appetites.

This guide looks at how to open an IBKR account in Singapore, including the IBKR account opening requirements and process. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

If you’re looking for a way to top up your Interactive Brokers account with more than 50+ currencies or manage the money you’ve withdrawn, why not try out Wise?

| Table of contents |

|---|

Before we look at how to open an IBKR account in Singapore, let’s consider why you might want to.

IBKR has been in business for almost 50 years, and serves almost 4 million clients in over 200 countries and territories, with access to 160+ global markets².

The platform allows you to trade stocks, options, futures, currencies, bonds, and funds with low fees, offering all the tools you need to view, transact, and trade at your convenience³.

Since IBKR provides access to a wide range of international markets, you can build a diversified portfolio across different countries, currencies, and asset classes. This can help you balance potential risks and rewards, and work toward your financial goals while minimising exposure to risk.

This guide is for information only, and does not constitute advice. The value of investments can go down as well as up - get professional advice before you put your money at risk.

To open an IBKR account, Singapore residents must be at least 18 years old for a cash account and 21 years old for a margin account.

Upon application, you’ll be asked to provide some information and documents, including⁴:

If you’re a US citizen - even while living in Singapore - you may also need to provide your Social Security Number (SSN) as part of your application.

You must provide paperwork for verification, including proof of identity and address. This can include:

| Document type | Acceptable Documents |

|---|---|

| Proof of identity |

|

| Proof of address |

|

If you don’t have these documents, other options may be accepted. Please refer to the official IBKR website for a complete list of required paperwork. Note that requirements may differ if you are applying from a country other than Singapore.

Before you decide to open an IBKR account in Singapore, it’s important to be clear about your own risk tolerance, goals, and available funds. You’ll need to provide information about your personal and financial situation as part of your application, so considering how you’d use your account in advance of applying is a smart move.

Let’s work through a step-by-step guide on opening an IBKR account in Singapore, if you’re ready to get started with investments:

- Open the IKBR website and click Open an Account.

- Create a username and password following the prompts.

- Confirm your email address for security reasons.

- Follow the prompts to enter your personal and contact information.

- Upload your proof of ID and address documents.

- Confirm your income and tax residency information.

- Complete the questions about your trading experience and objectives.

- Add your bank account information to fund your account.

- Upon verification, your account will be ready to trade.

Individual investors can choose from various different IBKR account types, including margin accounts and cash accounts. These are very different products, with their own target market.

Before you can use an IBKR cash account, you must fund it - which may mean waiting a day or two for your money to arrive if you send it by bank transfer. That can slow you down if you want to invest instantly, but it does mean you can’t lose more than you initially stake.

With an IBKR margin account, you may be able to borrow from the platform to invest using leverage. This can be quicker and may offer higher potential returns - but it is also riskier and can mean you lose more than you invested in the first place.

Here’s a quick comparison of IBKR margin vs cash account:

| IBKR cash account | IBKR margin account |

|---|---|

|

|

| Buying or selling a stock or shares that aren’t traded in your local currency? Don’t let the currency conversion trip you up. Convert your stocks or shares into any currency with our handy tool, and you’ll always know what you’re getting. Check out our international stock ticker tool. |

|---|

| Explore international stocks 🌍 |

Disclaimer: Wise's international stock ticker provides information for reference purposes only. This tool and platform does not offer to buy or sell stocks, and the data displayed here should not be considered financial advice. All investment decisions should be made after thorough research and consultation with a qualified financial advisor. We make no guarantees regarding the accuracy or completeness of the information provided, and users should exercise caution and seek professional guidance when making investment choices.

You can fund your IBKR account from Singapore in a selection of currencies, including SGD, GBP, USD, and EUR⁵.

You can pay into your IBKR account by bank transfer or using Wise. If you use your bank, the bank sets any applicable fees. If you’re sending from a Singapore SGD bank to credit your IBKR account in SGD, the costs may be relatively low. For international or foreign currency transfers, the costs are likely to be higher, and can include a currency exchange fee.

Interactive Brokers has integrated with Wise to offer a simple, one-step process for investors to fund their trading accounts in over 50 currencies.

Using Wise, you’ll be able to fund your IBKR accounts in a one-step process, in any currency you require. This means you can get the mid-market exchange rate with low, transparent fees and no hidden costs.

| Bank transfer | Wise | |

|---|---|---|

| Fees | Fees decided by your bank | Low, transparent fees apply if currency exchange is needed |

| Speed | Funds may take 1 business day to arrive | Funds can be available in hours |

| Simplicity | 2 step process - inform IBKR of the payment, and arrange via your bank | 1 step process - initiate from the IBKR app |

| Best for | Best for transfers where no currency conversion is needed | Mid-market exchange rates, make this best for currency conversion transfers |

To top up your IBKR account by bank transfer, you must first notify IBKR of each incoming deposit in the IBKR app. You can then contact your bank to transfer funds - this may be done online or in the bank’s mobile app, or you might need to visit a branch in person. Fees may apply - if you’re sending from SGD to be received in USD, for example, fees are likely to include currency conversion costs as well as transfer charges.

To transfer from Wise to IBKR, all you have to do is add Wise to your IBKR account and then use your IBKR account to initiate fund transfers from Wise in the currency of your choice. If you need to convert currencies, Wise uses the mid-market rate with low, transparent fees you can see in the app before you transact.

If you are buying or selling international stocks and funds listed abroad, you might be hit with extra costs for cross border money transfers.

When you’re ready to withdraw returns from your IBKR account, you can have the funds sent directly to your Wise account.

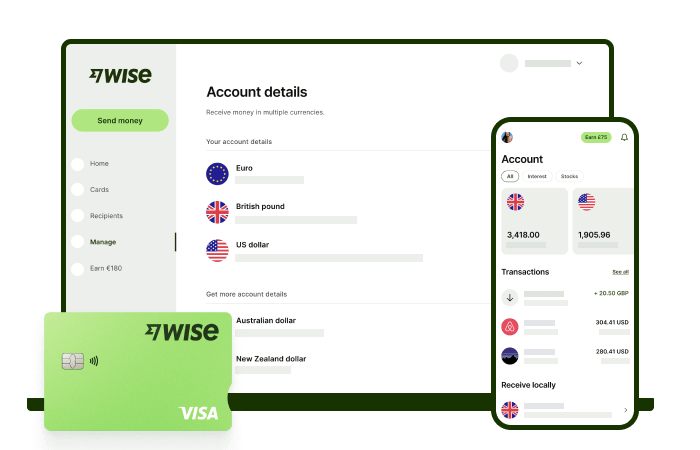

The Wise account is an easy way to hold and exchange 40+ currencies, including SGD, MYR, EUR, CNY, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.26% and absolutely no markups. Plus, you can order a linked Wise card for convenient spending without any foreign transaction fees, and up to 2 free ATM withdrawals to the value of 350 SGD when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in SGD and a selection of other major global currencies.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

Yes. Interactive Brokers Singapore Pte. Ltd. is licensed and regulated by the Monetary Authority of Singapore (MAS). As a major global brokerage, IBKR is also regulated by top-tier financial authorities around the world, including the U.S. Securities and Exchange Commission (SEC) and FINRA.

For most individual investors, there is no monthly inactivity fee. While some professional or institutional accounts may have specific fees or commission minimums, standard retail accounts do not.

It is a good choice for beginners due to its low fees and access to global markets, but the platform can be complex. For a simpler experience, new investors are advised to use the IBKR mobile app or Client Portal web platform instead of the advanced Trader Workstation (TWS).

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Looking for the best CIMB travel card in Singapore? We review the top cards for airport lounge access, travel insurance, cashback and more.

Looking for a detailed review on Saxo Singapore? Check out our guide on their platform, fees, features and investment products.

Compare the AMEX KrisFlyer Ascend, KrisFlyer, and Platinum cards. See their miles earning rates, annual fees, and perks to pick your best AMEX travel card.

Want to start investing with FSMOne? Find out if it is the right brokerage for you as we break down FSMOne fees, investment options, and features.

Looking to start using the Moomoo app? Check out our guide on how to trade, fund your account and avoid margin with Moomoo.

Considering retiring in Malaysia? This guide breaks down the average cost of living, top cities and the MM2H programme.