CIMB Visa Infinite Review Singapore (2025): The Best No-Fee Travel Card?

Looking for the best CIMB travel card in Singapore? We review the top cards for airport lounge access, travel insurance, cashback and more.

Saxo¹ is an established and popular digital brokerage that allows customers in Singapore to invest locally and internationally. If you’re considering using Saxo as a platform for your investments, you’ll want to learn more about how the accounts work, where you can invest, and what asset types are on offer.

Read on for our Saxo markets Singapore review. We’ll look at the different account types, features, and fees, and how to use Saxo to invest and trade. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

Saxo has been in business for over 30 years and now serves 1.2 million clients globally, including many in Singapore.

Saxo prides itself on having a great global range, including options to trade in 71,000 instruments across asset classes, covering FX, CFDs, ETFs, stocks, and bonds.

Saxo has features that make it suited to beginner investors, but it also offers more complex and risky products like margin accounts for experienced investors. This Saxo review looks at all the details you need to know to learn if it’s the right choice for you.

This guide is for information only, and does not constitute advice. The value of investments can go down as well as up - get professional advice before you put your money at risk.

Saxo Singapore is regulated by MAS and considered a safe and trustworthy provider.

It’s important to learn about investment risks before you begin to trade - but as long as you only invest money in ways that you’re comfortable with and understand the potential risks involved, Saxo is safe to use.

Saxo offers different account tiers depending on the value of assets you hold, which can see the costs you incur decreasing the more you invest. This can also make the platform an attractive choice for new investors, with no minimum deposit needed for a basic account, through to high-wealth individuals who get the premium tier of perks and the lowest overall costs.

You can buy stocks and other products from markets in Singapore, Hong Kong, the US, Europe, and other countries globally, offering plenty of ways to diversify your portfolio. As well as a full range of standard asset classes, you can invest in fractional shares, which is a good way to buy into big-ticket stocks with a lower initial outlay.

The range of investment products and instruments from Saxo includes:

- Stocks

- ETFs

- Bonds

- Mutual funds

- Crypto ETPs

- Leveraged Products

- Options

- CFDs

- Forex

- Crypto FX

- Futures

- Commodities

Aside from being able to buy and sell assets, Saxo also offers extra perks and services like pricing data, insights, and ideas to help you decide how to manage your money best within the platform. Resources include guides, videos, podcasts, and live events so you can learn more about investing and optimise your own strategies.

When you open your Saxo account, you’ll need to deposit funds to transact and trade. Depending on the amount you deposit within your first 30 days, you earn points, which can be converted into membership of a higher account tier, earning you lower fees and tighter margins.

You can also earn points based on the way you trade once your account is established, to give you the chance to move account tiers at a later stage in your investment journey.

Here’s how the different Saxo account types work for features and key fees²:

| Feature/fee | Classic | Premium | VIP |

|---|---|---|---|

| Minimum deposit needed | No minimum | 300,000 SGD | 1.5 million SGD |

| US stock and ETF transaction fees | 0.08% | 0.05% | 0.03% |

| US stock options | 2 USD | 1 USD | 0.75 USD |

| US stock CFDs | 0.06% | 0.05% | 0.04% |

| Major FX pairs from | 0.6 pips | 0.5 pips | 0.4 pips |

| Other benefits | 24/5 support | Priority support |

|

*Details correct at time of research - 14th August 2025.

All account tiers benefit from the following:

We’ve mentioned the 0.25% currency conversion fee used by Saxo. This is important to understand if you intend to trade in foreign currencies. Every time you trade in a foreign currency, including making conversions within your own sub-accounts in foreign currencies, you’ll get an exchange rate that includes a fee of 0.25%. You’ll be able to see the live rate being applied in the Saxo app before you confirm any transaction³.

If you’re trading in currencies other than SGD, you might find that using an account from a provider like Wise is a good way to minimize your spending on fees when you convert currencies. More on that later

You can open a Saxo account online or through the Saxo app, with a convenient digital application, verification, and onboarding experience.

Here’s how to open a Saxo account⁴:

During your application, you are likely to be asked to upload documents which include⁵:

If any further information or documents are needed to secure your account with Saxo, you’ll receive an email to let you know what steps to take.

You can deposit money into Saxo in a broad variety of ways. Your exact options depend on the currency you want to deposit - here’s a rundown of your usual options:

| Currency or currencies | Payment methods available |

|---|---|

| SGD |

|

| USD |

|

| CAD, CHF, CNH, DKK, EUR, GBP, HKD, JPY, NOK, NZD, SEK | Bank transfer |

| MYR | Bank transfer from an onshore MYR bank account held in Malaysia |

If you want to make your deposit by bank transfer, you can get the Saxo account information required from the app or by logging into the online system. Bear in mind that the details needed do vary by currency. You can also get details for other payment methods like PayNow⁶:

Once you have the Saxo account information needed, you can add money using your preferred method. Bear in mind that if you’re transferring from your bank, you must include your client ID and your payment must come from an account held in your own name.

If you have money in Saxo from the sale of assets, dividends, maturing bonds, or other sources, you can withdraw it in a selection of currencies.

Here’s how to withdraw money from Saxo⁷:

| Buying or selling a stock or shares that aren’t traded in your local currency? Don’t let the currency conversion trip you up. Convert your stocks or shares into any currency with our handy tool, and you’ll always know what you’re getting. Check out our international stock ticker tool. |

|---|

Explore international stocks 🌍

Disclaimer: Wise's international stock ticker provides information for reference purposes only. This tool and platform does not offer to buy or sell stocks, and the data displayed here should not be considered financial advice. All investment decisions should be made after thorough research and consultation with a qualified financial advisor. We make no guarantees regarding the accuracy or completeness of the information provided, and users should exercise caution and seek professional guidance when making investment choices.

Before you invest or buy stock with Saxo, you can create a watchlist of the instruments you are interested in buying, so you can track their performance and so you can keep your ideas organised for future trades.

You can then buy from the watchlist, and also on the same page of the Saxo website or app, you can set sell orders and manage your account and transactions. Here’s what to do⁸:

Aside from market orders, you also have options to buy at a preferred price, using a limit order. This allows you to specify a price, and then the platform will automatically initiate the trade if the asset reaches that value.

Looking to sell assets? Within the app, you can set specific triggers for the sale of your assets if you would like to ensure they are sold when they reach a predesignated price.

Avoid Saxo's exchange rate markups and 0.25% conversion fee by funding your account directly with Wise.

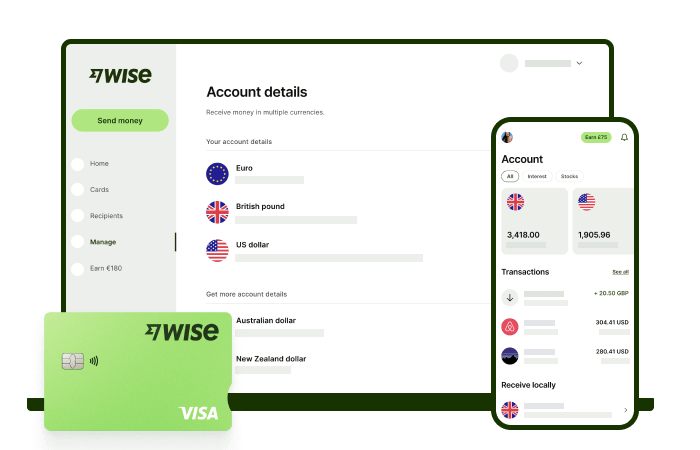

The Wise account is an easy way to hold and exchange 40+ currencies, including SGD, MYR, EUR, CNY, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.26% and absolutely no markups. Plus, you can order a linked Wise card for convenient spending without any foreign transaction fees, and up to 2 free ATM withdrawals to the value of 350 SGD when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in SGD and a selection of other major global currencies.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Looking for the best CIMB travel card in Singapore? We review the top cards for airport lounge access, travel insurance, cashback and more.

Compare the AMEX KrisFlyer Ascend, KrisFlyer, and Platinum cards. See their miles earning rates, annual fees, and perks to pick your best AMEX travel card.

Want to start investing with FSMOne? Find out if it is the right brokerage for you as we break down FSMOne fees, investment options, and features.

Looking to start using the Moomoo app? Check out our guide on how to trade, fund your account and avoid margin with Moomoo.

Learn how to open an IBKR account in Singapore in 2025. We cover requirements, funding process, and explain the difference between margin and cash accounts.

Considering retiring in Malaysia? This guide breaks down the average cost of living, top cities and the MM2H programme.