How To Use WorldRemit To Receive Money In South Africa

Your guide on how to receive money from WorldRemit in South Africa, including collecting money as a cash pick up and documents you need to make an account.

Standard Bank is one of the largest banks in South Africa and the biggest in all of Africa as a lender of assets. It was established in 1862 and has been a major player in the country’s banking scene. It is present in several other African countries. It is a popular choice for expats looking to open an account in the country as well as locals.

Capitec is another major bank in South Africa with millions of customers. If you’re someone with an account in Standard bank and are looking to transfer money to your own account or someone else’s in Capitec you’ve come to the right place. Our guide gives you the step-by-step on how to transfer money from Standard Bank to Capitec and also discusses the fees and timelines associated with it.

We’ll also introduce to you Wise for international money transfers to South Africa at the mid-market exchange rate - similar to the exchange rate you see on Google.

Yes, transferring money from Standard Bank to Capitec is possible and very straightforward. In the last ten years, banking in South Africa has undergone a significant transformation. The tedious process of visiting a bank branch, waiting in line, and completing paperwork to transfer money is largely a thing of the past. While traditional methods are still an option, most people now enjoy the simplicity of managing transactions from their homes with just a few taps on their smartphones. Leading banks like Capitec and Standard Bank process millions of transactions daily and have pioneered digital innovations, making interbank transfers faster and more convenient than ever. Capitec, South Africa’s largest bank by customer numbers, is a top choice for locals and expats alike thanks to its innovative banking options and excellent customer service⁷.

Standard Bank has made the process of sending money to Capitec or other banks easy and stress-free. Whether you’re paying someone or moving money between your own accounts, the transfer can be done quickly and conveniently. In the sections ahead, we’ll guide you through the different ways to transfer money from Standard Bank to Capitec, step by step.

Transfers between Standard bank accounts are free when done online and cost R75 through a branch. However, if you're transferring funds to another bank, like Capitec, the fee is higher. It costs R1.2 for digital transfers and R75 if you transfer through the branch⁶. Immediate payments of amounts below R3000 would cost you R10 in fees whereas amounts above that incur a fee of 0.3% of the value (minimum R312 up to a maximum R1560)⁶.

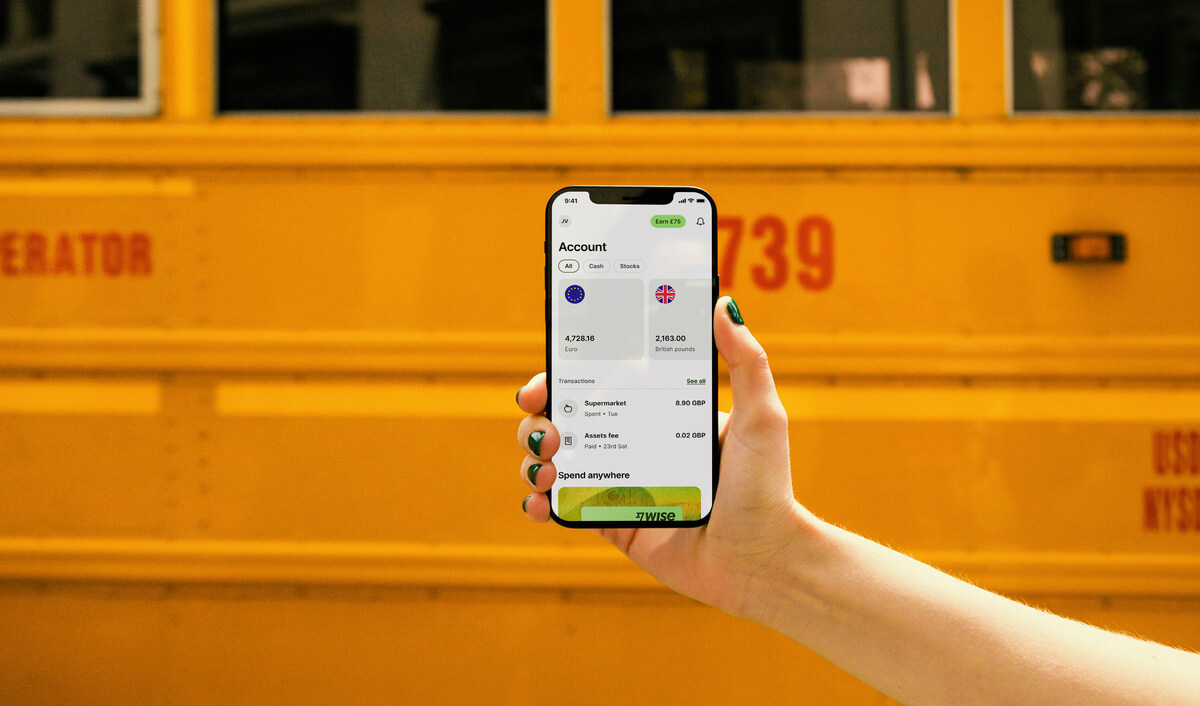

If you’re living in South Africa, Wise can help you save money¹ when making international money transfers to South Africa.

Although the majority of banks may allow their account holders to make an international transfer, it is possible that a markup is added to the mid-market exchange rate. Find out what you would pay for an international money transfer with Wise:

The mid-market exchange rate is the rate that banks use to transfer money between them and is considered the fairest rate in the market. It is recommended to check the exchange rate offered by your bank against the mid-market rate, which is similar to the exchange rate shown on Google. Say no to hidden fees!

Wise customers don’t have to pay an additional markup fee but only a small transparent fee to make an international transaction¹. That’s because Wise uses the mid-market rate for overseas payments!

One of the easiest and most common ways to transfer money is through online banking. Here is how to do it:

If you prefer to use your smartphone, the Standard Bank app offers a convenient method of making money transfers:

Transferring money using the EFT (electronic fund transfer) from your Standard Bank account to Capitec can take around 15-30 mins⁸. Keep in mind this does not include weekends or any public holidays. These typically cause a delay in the transfer reaching the recipient.

Standard Bank offers an immediate payment option for an additional fee, but this service has specific timeframes and might not be available for all transfers.

Moving money from Standard Bank to Capitec has never been easier. With multiple options like online banking, mobile apps, ATMs, and in-branch services, you can choose the method that best fits your preferences. Whether you're transferring funds to your own account or to someone else's, the process is efficient and user-friendly.

While fees and timelines may vary depending on the type of transfer, Standard Bank provides flexibility with options like immediate payments for urgent transfers.

You can also try Wise as for receiving money at the mid-market rate for international transfers to South Africa.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Your guide on how to receive money from WorldRemit in South Africa, including collecting money as a cash pick up and documents you need to make an account.

Everything you need to know about how to receive money from Western Union in South Africa, including how and where to pick up cash, and the documents you need.

Discover how to send money abroad from South Africa using Payoneer, including the transfer fees, exchange rate and what you need to make a payment.

Everything you need to know about international transfers with Mama Money, including transfer fees, which countries you can send to and transfer limits.

The easy guide on how to receive money from PayPal in South Africa, including international PayPal fees and how to link your South African bank account.

Need to transfer money from Capitec to FNB but unsure on how to? Our guide has you covered!