How To Use WorldRemit To Receive Money In South Africa

Your guide on how to receive money from WorldRemit in South Africa, including collecting money as a cash pick up and documents you need to make an account.

TymeBank recently became Africa’s first digital bank to reach 10 million customers⁵. It is also the first digital bank in the region to become profitable since its launch in 2019⁵. Unlike the big brick-and-mortar South African banks, TymeBank doesn't operate from any branches, relying on online and mobile banking platforms and physical locations in partnership with Pick 'n Pay⁵.

The bank received its license from the South African Reserved Bank to run operations back in 2017, however, they still don’t have the clearance needed to send international payments⁷. This means that if you'd like to send money abroad using your TymeBank account, you'll need to use a third-party transfer service. Our guide helps you uncover all there is to know about having a TymeBank account, from account opening to international money transfers.

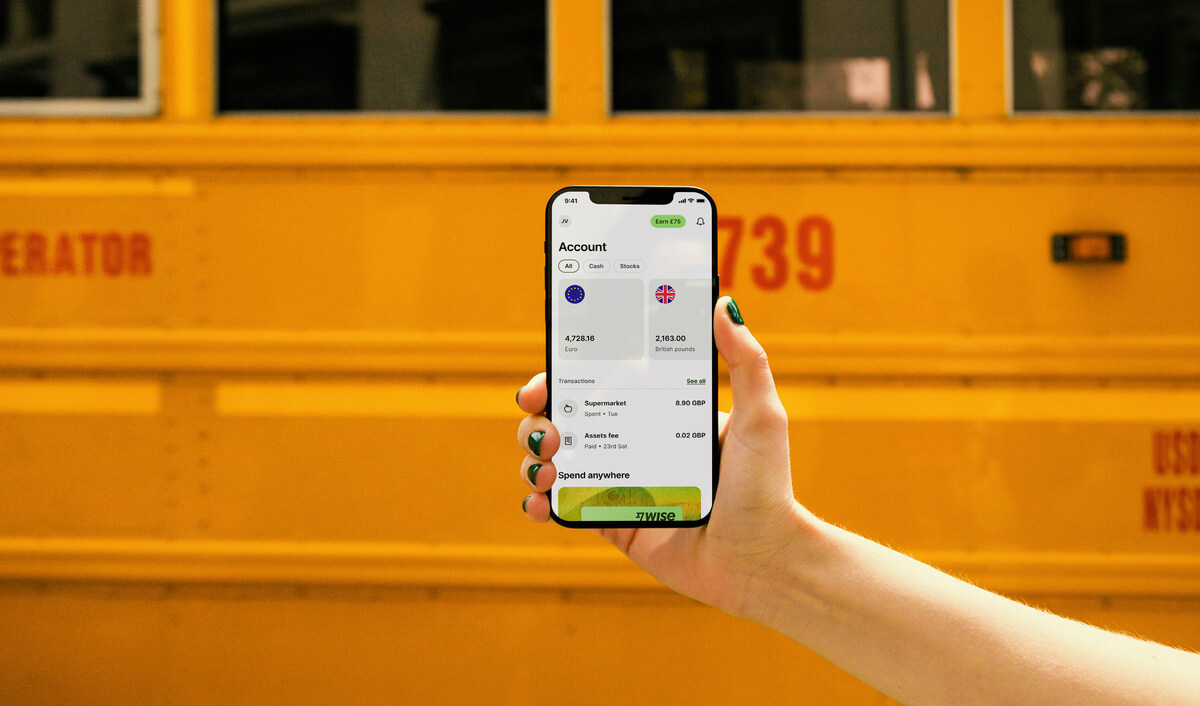

We also introduce you to Wise – an alternative that helps you receive international payments in South Africa at the mid-market exchange rate (similar to the rate you see on Google!).

A SWIFT code (also called the SWIFTBIC) is a code that helps banks abroad identify which bank to send money to. The SWIFT/BIC code for TymeBank South Africa is CBZAZAJJXX and needs to be used when sharing banking details to receive money⁶.

You can open an account with the bank in under 5 mins online, more so there are no monthly fees meaning you can enjoy all the benefits of the account at zero extra cost¹¹! The steps to open a TymeBank account are as follows¹²:

Yes, it’s that easy, but that’s not all. Despite being a digital bank, Tyme has now partnered with The Foschini Group (TFG) to increase reach and bridge the gap between traditional and digital banking. You can now use one of the 600 kiosks at TFG stores to open a TymeBank Account¹¹!

Unlike other banks that require you to present your passport, proof of address, proof of right to study or work, banking history, and even a minimum deposit, TymeBank asks that you provide just 3 simple things¹²:

If you have any queries about their requirements or are confused about the process the bank provides answers to the most common questions on their FAQ page. You can also reach them through the contact us option on their website.

While TymeBank has been a key player in the digital banking revolution in the country it still cannot make international transactions. This is because the SARB restricts the bank from dealing with these transactions⁷.

Foreign exchange is heavily legislated in South Africa and these restrictions come as part of the country’s Exchange Control Regulations. Under these TymeBank is restricted from performing international wire transfers, buying and selling foreign banknotes, or offering any other forex services.

But there is a way you can receive international payments in your TymeBank account, only it won’t come in directly from the sender. Payments you receive from overseas will need to be routed through Absa, FNB, Nedbank, or Standard Bank and converted into ZAR at the exchange rates offered by these banks⁸. You need to be aware that you could receive less money than you expected due to markups that are added by banks in the exchange rate¹².

As discussed, earlier TymeBank is currently unable to perform international wire transfers directly. But there are a few alternatives you can use to send money abroad, we delve into some of the popular ones below:

| Provider | Specifics | Value |

|---|---|---|

| WorldRemit⁷ | Transfer fee + conversion fee | R7.50 + 2-3% |

| Payment method | Credit/debit card, EFT | |

| Processing time | 1 - 2 business days | |

| Ideal for | Transfers of small amounts to Americas, Asia-Pacific, and Africa | |

| Mama Money⁷ | Transfer fee + conversion fee | R48-R89 + 2-3% |

| Payment method | Credit/debit card, cash, EFT via Ozow | |

| Processing time | 5 hours - 2 business days | |

| Ideal for | Transfers to Europe and also for transfers paid for by cash deposit. | |

| FX Broker⁷ | Transfer fee + conversion fee | Varies, but usually <2% |

| Payment method | Credit/debit card, cash, EFT | |

| Processing time | May vary | |

| Ideal for | Large transfers of R75,000 or more. | |

| Banks⁷ | Transfer fee + conversion fee | Varies, but usually >5% |

| Payment method | Credit/debit card, cash, EFT | |

| Processing time | May vary | |

| Ideal for | Those who don't mind higher fees to stick with the bank. |

You cannot accept incoming international payments to your TymeBank Everyday account. Please do not attempt to receive international payments into your EveryDay Account. The funds will not reflect and will take up to 14 days to be returned to the sender⁸.

As an alternative you can download the Shyft App or use a global money transfer provider such as Wise to manage your inward international payments effectively.

If you’re living in South Africa, Wise can help you save money¹ when making international money transfers to South Africa.

| Although the majority of banks may allow their account holders to make an international transfer, it is possible that a markup is added to the mid-market exchange rate. It is recommended to check the exchange rate offered by your bank against the mid-market rate, which is similar to the exchange rate shown on Google. Say no to hidden fees! |

|---|

The mid-market exchange rate is the rate that banks use to transfer money between them and is considered a fair market rate. Find out what you would pay for an international money transfer with Wise:

Wise customers don’t have to pay an additional markup fee but only a small transparent fee to make an international transaction¹. That’s because Wise uses the mid-market rate for overseas payments!

Sending money from your South African bank account to a person overseas requires you to have the following details about them:

To receive international payments on the other hand you will need to provide your IBAN (account) number and state why the money is being sent to you. Be sure to take your ID along too.

You should expect a processing time between one to three business days for payments made internationally⁹. Verifying the purpose of transfer is essential if you are receiving money from outside of South Africa for security reasons⁹. Upon confirming the bank processing the payment typically exchanges the money using the current exchange rate and almost immediately transfers it to your account.

Transferring popular global currencies like the Euro or US dollar is usually faster than less common currencies⁹.

In South Africa, like other countries it is important that you understand currency exchanges well for a smooth banking experience. TymeBank is a digital first bank headquartered in Johannesburg that makes online banking easy and is quickly rising in popularity. It doesn’t use traditional branches. However, TymeBank users can’t send money abroad directly due to South African Reserve Bank rules.

For receiving international payments, on the other hand, you can look into Wise – an international transfer service provider that allows you to receive international payments at the mid-market exchange rate.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Your guide on how to receive money from WorldRemit in South Africa, including collecting money as a cash pick up and documents you need to make an account.

Everything you need to know about how to receive money from Western Union in South Africa, including how and where to pick up cash, and the documents you need.

Discover how to send money abroad from South Africa using Payoneer, including the transfer fees, exchange rate and what you need to make a payment.

Everything you need to know about international transfers with Mama Money, including transfer fees, which countries you can send to and transfer limits.

The easy guide on how to receive money from PayPal in South Africa, including international PayPal fees and how to link your South African bank account.

Need to transfer money from Capitec to FNB but unsure on how to? Our guide has you covered!