GCash Cash In Fees: A guide to fees, limits and free methods in 2025

A transparent guide to GCash cash-in fees. Get a full breakdown of charges at different partners and learn the best methods to cash in for free.

If you’re expecting a Transfast1 remittance being sent to you from abroad, you might be wondering if you can receive a Transfast to GCash2 payment to make it more convenient to spend your money here in the Philippines.

This guide walks through how to get money from Transfast to GCash accounts in the Philippines so you can decide if it’s the best option for your needs. We'll also touch on things like eligibility, fees, and transaction times - everything you need to know about receiving money from Transfast to Gcash.

Transfast offers international transfers to people sending money overseas, with options to deposit money to banks, and wallets like GCash.

You can also use Transfast to send money to the Philippines to receive in cash, through an agent network. If you’re wondering where to claim a Transfast remittance in the Philippines, the good news is that there are hundreds of thousands of agents globally, so you should be able to find one nearby easily enough.

Transfast primarily operates in the Gulf Cooperation Council countries including the UAE, Dubai, Qatar and Oman. If someone is sending you money from this region, this guide covers how to receive their payment to GCash.

To receive money in your GCash account you’ll need to meet the following eligibility requirements:

Before you receive a payment from Transfast to GCash you need to get your GCash account properly verified. Remittances can only be received to GCash if you have a verified account. It may take 3 days to change your account limit and status, so do take this step before the person sending you money has initiated the payment at their end.

You can get verified on GCash by uploading a government ID document - usually one of the following4:

- National ID (Card Type)

- National ID (Paper Type) / Digital National ID

- Passport

- HDMF (Pag-Ibig Loyalty Plus)

- Driver's License

- Philippine Postal ID

- PRC ID

- UMID

- SSS ID

You’ll also need to take a selfie and upload it.

As well as having a verified GCash account, you’ll also need to make sure your incoming payment doesn’t exceed any of the applicable wallet limits based on the account tier you hold. This will usually mean you can receive or hold up to 100,000 PHP if you have a verified account.

If you’re expecting someone to send you money to GCash through Transfast you’ll need to give the sender your full name and the phone number you used when you signed up with GCash. The sender will usually also need to provide a reason for the payment.

Once the payment is on the way, the sender will get a transfer reference number which is required for receiving the remittance to GCash - ask them to send you this before you head over to GCash.

| 👀 Looking for a smart, low-cost way to send or receive remittances? Learn more about how to use Wise in the Philippines |

|---|

Sign up for a free Wise account

When the sender has set up the payment to GCash through Transfast, they’ll receive a reference number which you must use to claim your money through GCash. This is a security step which helps make sure that transfers arrive safely in the recipient account.

To claim your Transfast remittance to GCash, take the following steps5:

You’ve got 90 days to claim your remittance, and the money is instantly available in your GCash account once you claim it.

It’s not too difficult to get your money from Transfast to GCash - in fact once your payment is initiated you can pretty much just sit back and wait for it to arrive. Let’s cover another couple of common points to think about.

Ask your sender to get a delivery quote when they send your payment through Transfast, so you can see how long it’s likely to take. Transfast doesn’t advertise any specific delivery time, and it is likely that the length of time to send money depends on factors like how the sender chooses to pay

There’s not usually any fee to receive a remittance to GCash. However, that’s only half of the story. The chances are that the person sending you money will have needed to pay a fee when they initiated the transfer. This can be a variable charge which is likely to depend on the country of origin and how the sender wants to pay for the transfer. On top of this, there could be a charge in the exchange rate used - more on that next.

Transfast offers cross currency payments - which means the sender will pay for the transfer in their home currency, and you’ll receive it in PHP. To facilitate this transfer, Transfast will exchange currencies, using their own exchange rate. This may include a fee.

Transfast adds a margin to the exchange rate they use to convert the sender’s currency to PHP6. This is a percentage fee which is rolled up into the rate, making it hard to see or calculate. Exchange rate margins tend to vary depending on the currency in question, but can add a significant amount to the overall costs of an international transaction.

Some providers do not use an exchange rate margin. Instead they pass on the mid-market exchange rate - the one you see on Google - and add a transparent fee for currency conversion which is split out from the rate, to make it easier to see. We’ll look at one example provider which operates this way - Wise - in a moment.

Transfast has hundreds of thousands of global partners if you choose to receive your payment in cash. You’ll need to check with the person sending you money, where the payment is headed to. Options in the Philippines include branches of M Lhuillier, LBC, Palawan, Villarica and more.

Check out Wise which uses the mid-market rate with low, transparent fees6.

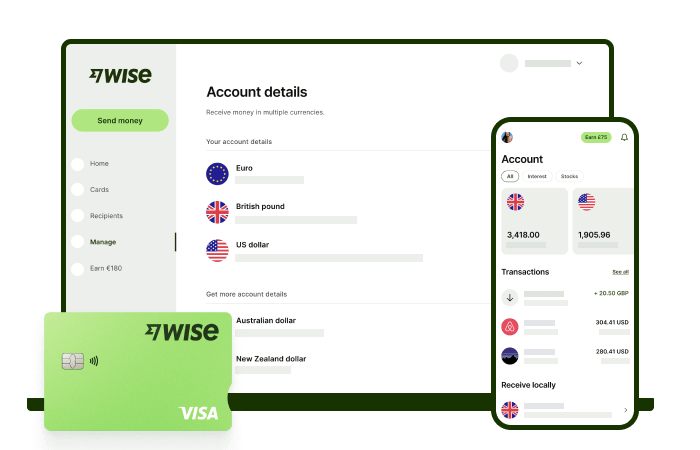

Wise supports online and in app payments from many countries and regions globally. Your sender can process a Wise payment to your GCash account, or to a bank account in the Philippines - which will often be super quick to arrive, so there’s no hanging around waiting for your money.

Ang Wise account ay isang madaling paraan mag-hold at mag-exchange ng 40+ currencies, kasama na ang PHP, USD, CNY at marami pa. Kailangan mo lang gumawa ng libreng account para makapagsimula.

Sa Wise, pwede kang mag-exchange ng pera sa mid-market rate, yung totoong exchange rate na nakikita mo online, na walang patong! Plus, pwede ka rin mag order ng Wise card para mas convenient gumastos na walang foreign transaction fees. At kung kailangan mo ng cash, pwede ka ring mag-withdraw ng up to 2 beses nang libre (up to 12,000 PHP) kapag nasa abroad ka. Makakakuha ka pa ng 8+ local account details para direkta kang mabayaran sa Wise account mo sa peso at sa iba pang major global currencies.

Magse-send ka ba ng money or magbabayad abroad? Nag-o-offer din ang Wise ng fast at low-cost transfers na abot 140+ countries - pwede mong i-track ang transfer mo sa account mo at ma no-notify din ang recipient mo kapag dumating na yung transfer.

| This content incorporates publicly available data points from as part of research and comparative analysis conducted as of 4 November 2024. The information and insights provided are for informational and illustrative purposes only and may not reflect the most current data. Readers are advised to independently verify and cross-check the information before making any decisions or proceeding further. |

|---|

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A transparent guide to GCash cash-in fees. Get a full breakdown of charges at different partners and learn the best methods to cash in for free.

Want to cash out from Lazada Wallet to GCash? Learn more about how to transfer, convert, and refund credits.

Want to transfer money from BPI to GoTyme? Learn more about how to send money across platforms.

Want to transfer money from Maya to SeaBank? Learn more about how to send money across platforms.

Want to transfer money from BDO to Maya? Learn more about how to send money across platforms.

Want to transfer money from SeaBank to PayPal? Learn more about how to send money across platforms.